UK : 63, St Mary Axe, London, United Kingdom, EC3A 8AA

AU : Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

Email Us Mon-Fri, 10:00 AM to 6:00 PMWill 2024 be a challenging year for debt capital markets?

Global Debt Market: Overview

Amid ongoing uncertainty in macroeconomic environment and unpredictable geopolitical tensions, the default rates have escalated to a new level in 2023. In effect, the concerns related to debt instru- ments have been raised among the debt investors. Owing to the downgraded debt recoveries in the recent period, especially in the US, Europe, and Canada, the estimated targets of the recovery rates by S&P Global Rating are highly probable to trade lower relative to the historical averages. Primarily, this article focuses upon the performance of Fixed income instruments trading in the US capital market.

US Fixed Income Market

© 2024 Krish Capital Pty Ltd.

Data Source: Securities Industry and Financial Markets Association (https://www.sifma.org/) , Analysis: - Haanuwise

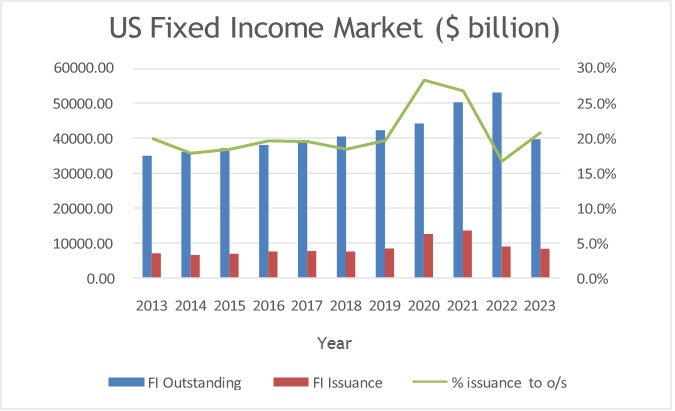

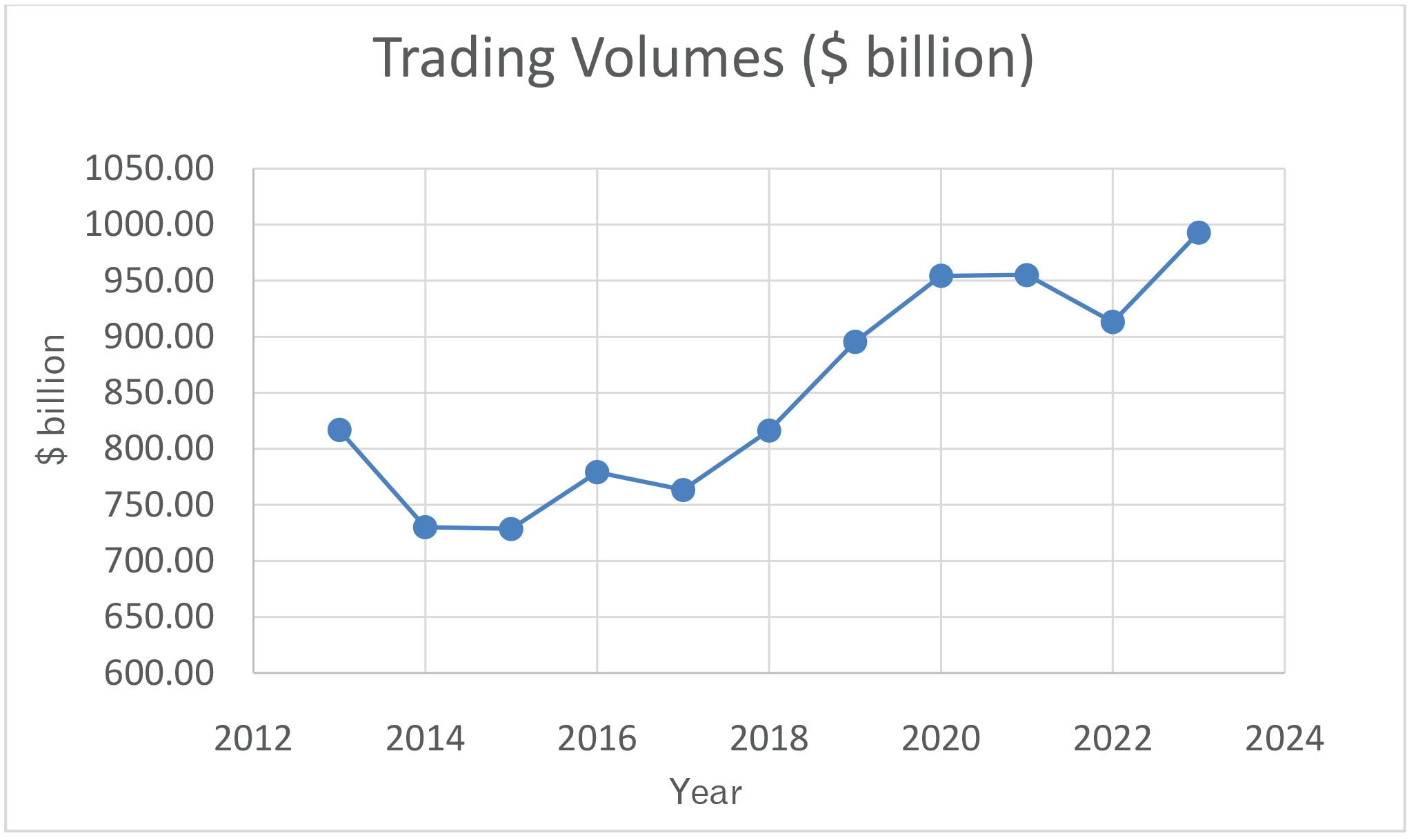

The trendline between 2021 to 2022 end has crumbled excessively because of continuous interest rate hikes by Fed. The rising interest rate has caused inflationary pressure within the capital market due to which the consumption rate went substantially down among the debt investors. Earli- er, Fed was following a strategy of down casting rates to support COVID-pandemic aftermath. Later, in the post-pandemic period, when the health crisis started to stabilize, the Fed attempted to benefit from interest rate hikes, leading to distressing consumption estimates among the house- holds.

Therefore, in the graph, it can be observed that new issuance significantly lowered in the period of the interest rate hikes from 2021 to 2022. During this period, the investors shifted their focus towards equity capital market as the value of equities rallied up in the post-pandemic period, reach- ing new records. This did not cater to new bond investorsbecause of which percentage of Fixed Income issuance relative to Fixed Income outstanding declined during 2021-2022.

Image Source: © 2024 Krish Capital Pty Ltd.

Image Source: © 2024 Krish Capital Pty Ltd.

Data Source: Securities Industry and Financial Markets Association (https://www.sifma.org/) , Analysis: - Haanuwise

In the current macro environment, the fixed income instruments have become quite lucrative invest- ment class for a prolonged period. In the previous stream of interest rate hikes by Fed, 10-year US treasury yielded at the peak of 5%. Although, with slightly higher interest rates at the start of 2024, the 10-year Treasury securities are yielding around a range of 4.20% to 4.30%.In the effect of holding back a series of hiking interest rates by Fed, the bond market started to gain demand among the investors. As a result, the trend line of bond issuance relative to overall outstanding amount is mounting upwards. The stable yield range has uplifted the investors’ confidence by reinforcing their consumption capability. New investors are finding an attractive opportunity in the debt market to progress their investment goals,

Image Source: © 2024 Krish Capital Pty Ltd.

Data Source: Securities Industry and Financial Markets Association (https://www.sifma.org/) , Analysis: - Haanuwise

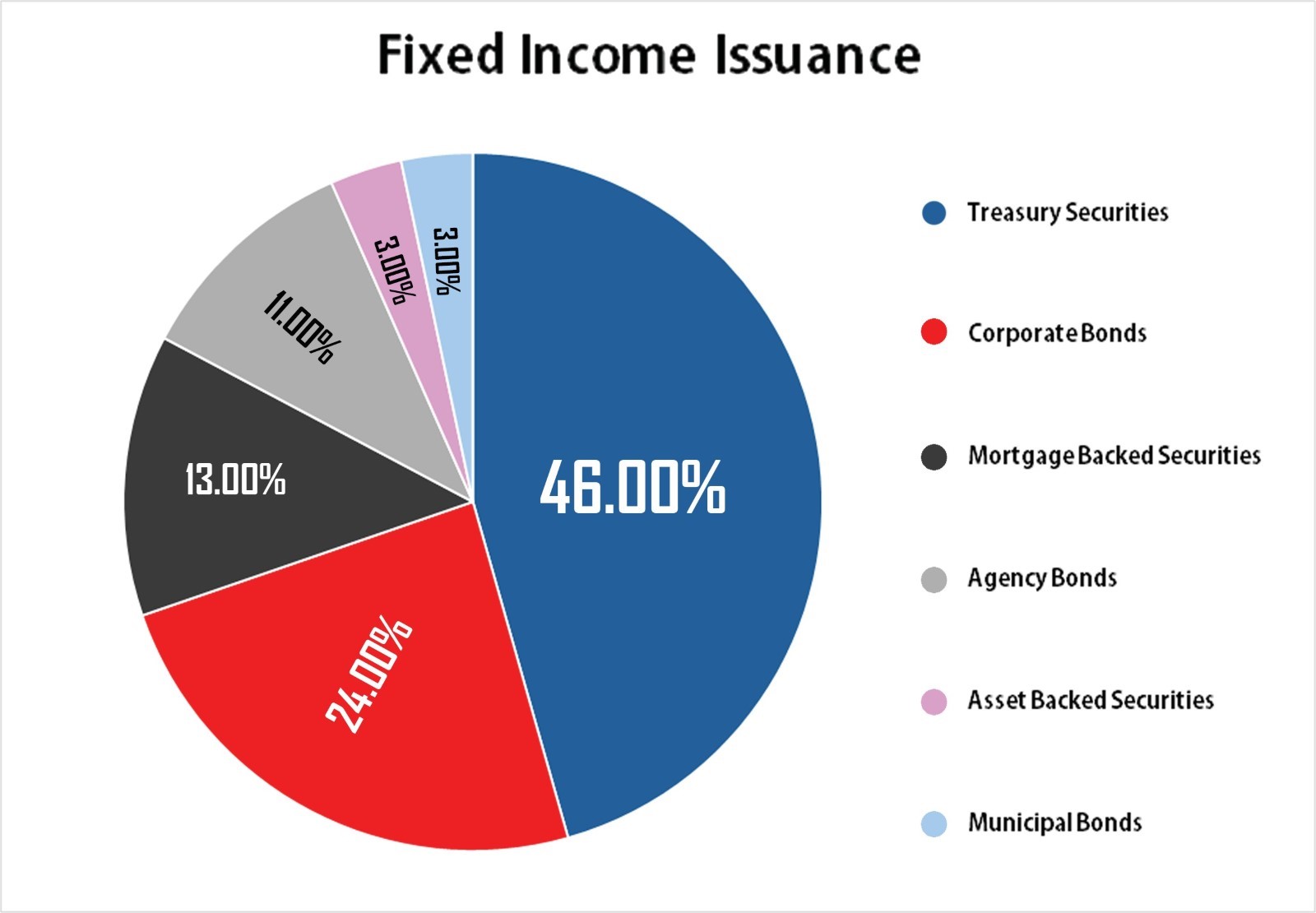

Considering the US market, Treasury securities (45.60%) and corporate bonds (24.13%) contribut- ed the most proportion among the listed securities within the fixed income asset class. Over the period from 2013-2023, treasury securities gained significant attention from investors as the eco- nomic state dwindled. Investors consider treasuries as a relatively safer investment, owing to their liquidity attribute.

Image Source: © 2024 Krish Capital Pty Ltd.

Image Source: © 2024 Krish Capital Pty Ltd.

Data Source: Securities Industry and Financial Markets Association (https://www.sifma.org/) , Analysis: - Haanuwise

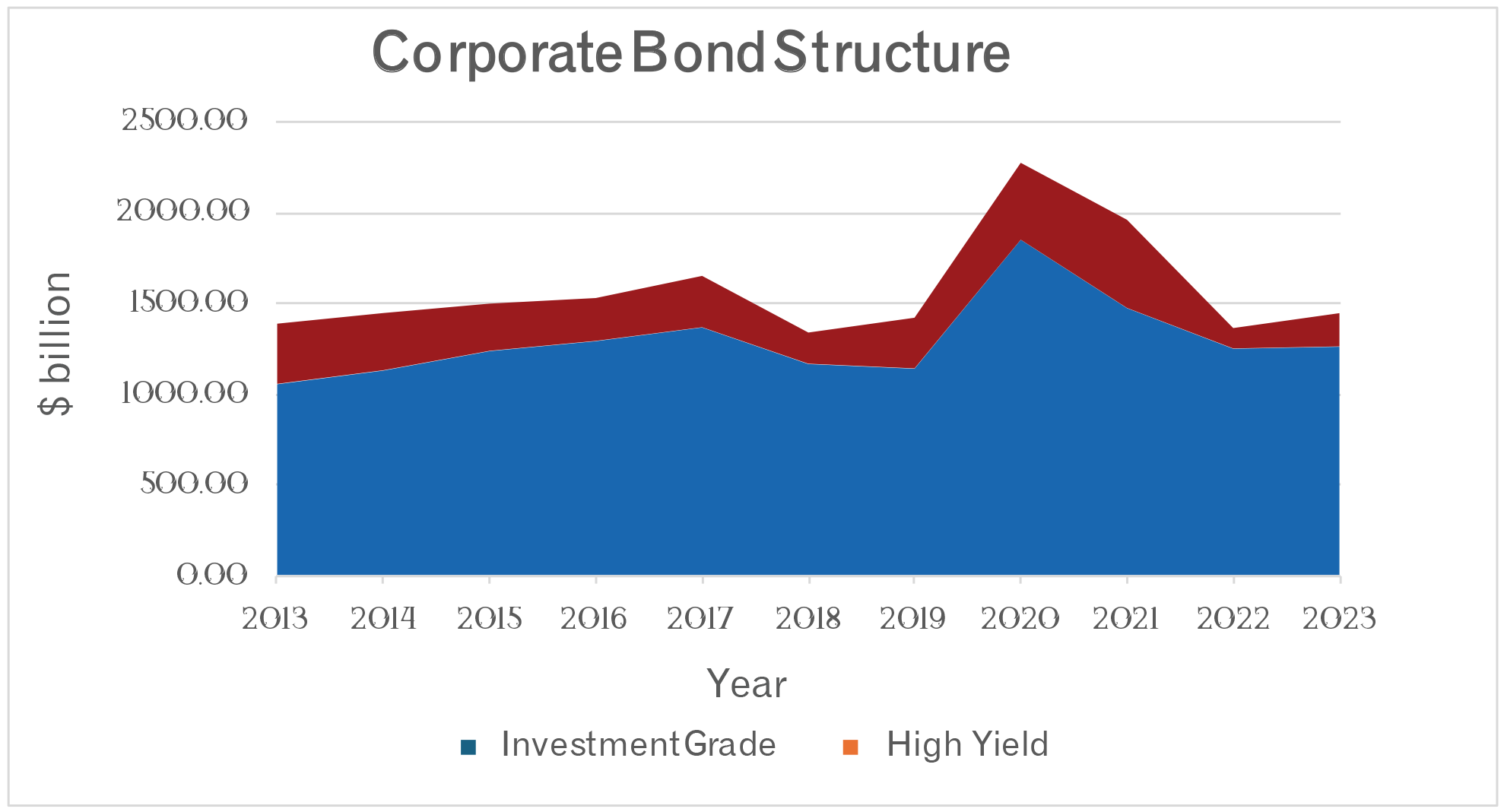

The corporate bond issuance also contributed to the reinforcement of the US debt market. Over time, especially in the post-pandemic period, the demand from domestic as well foreign portfolio investors have heightened as the macroeconomic conditions eased up. The surging investors’ demand has encouraged the companies to tap the bond market in fulfilling their refinancing needs. Moreover, the notable sectorial improvement within the US has provided immense opportu- nities for the companies. Especially, the strong cash flow projections in the post-pandemic period, the companies are engaging themselves in the potential M&A activities. These potential M&A transactions are likely to be fulfilled with debt financing, owing to its cheaper financing cost relative to equities. This is securing the investor’s interest in this dynamic business environment.

Even the Fed rates are on a declining trail but are still higher than the levels trading at the beginning of 2022. The bond yields are rising duringthe Fed’s response to inflation, strengthening US economy, and most importantly the rapidly increasing US Treasury supply.The investment grade bonds are currently oversubscribed with an inference to relatively greater demand for such asset class in lieu of elevated estimates of bond yields. The spread remained steady, but the core rates fluctuated excessively, resulting in outperformance of high yield bonds relative to investment grade bonds. However, the investment grade bonds tend to exhibit defensive characteristics and benefit from the ongoing macro events. The high yield bonds have replicated the equities’ performance, owing to their risky nature, thereby gathering more returns than investment grade bonds during inflation.

Outlook

The debt market stands out with a mixed outlook for the future period. With an expectation of a stag- nant range of Fed rates, the corporates are likely to secure their borrowing cost by issuing bonds at lower interest rates. As a result, the corporate bond issuancemay escalate over a prolonged period amid heightened demand from foreign players and relatively lower borrowing costs. Earlier, in Janu- ary 2024,the FED announced its plan to uphold the policy rate between 5.25% and 5.50% until they gain increased assurance regarding inflation's movement towards the Federal Reserve's 2% objec- tive.

However, for the full year 2024, the Federal Reserve has projected a 75-basis-point rate cut. Conse- quently, Treasury yields, influenced by interest rate expectations, have risen. On 4th April 2024, the benchmark 10-year yield, which moves inversely to bond prices, reached its highest level at 4.39% since November.

As a result of declining interest rates, the demand for bond instruments would incidentally go down. The bond prices would go up in response to declining interest rates, restricting the investors to park their money in the debt market. In effect, the proportion of bond issuance would deflate to some extent.

Further, according to comments made by Fed Governor Christopher Waller, there could be a possible shift in asset purchase composition towards an increased allocation of shorter-dated Treasuries as opposed to mortgage-backed securities.

Disclaimer – The information available on this website is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.