UK : 63, St Mary Axe, London, United Kingdom, EC3A 8AA

AU : Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

Email Us Mon-Fri, 10:00 AM to 6:00 PMUS Healthcare Sector 2024 and Beyond: Innovations, Spending, and Growth

The healthcare sector is experiencing a groundbreaking transformation fueled by demographic shifts, technological advancements, and changing patient needs. COVID-19 has fundamentally reshaped numerous industries, notably healthcare,

bringing promising advancements in technology and treatment methodologies. Although returning to pre-pandemic practices may present obstacles, this shift holds the potential for favorable outcomes, signifying a crucial juncture in healthcare delivery and response capabilities.

Complexity and Growth in US Healthcare

The healthcare system in the United States is among the world’s most complex, charac- terized by intricate connections among providers, payers, and patients seeking care.

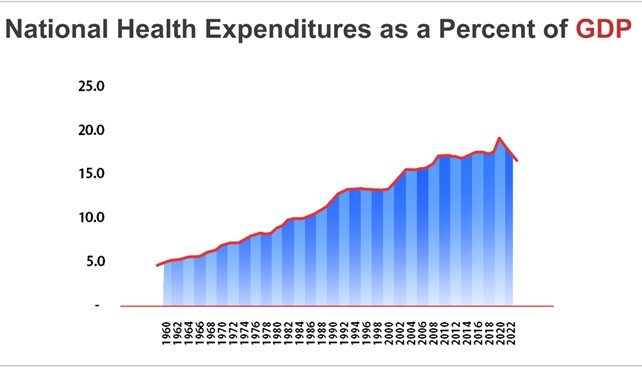

As per the US National Health Expenditure (NHE) fact sheet, healthcare spending reached a staggering USD 4.5 trillion following COVID-19 in 2022, witnessing a notable 4.1 percent increase from the preceding year. This growth was largely attributed to robust increases in Medicaid and private health insurance expenditures. However, this growth was somewhat offset by ongoing declines in supplemental federal funding in response to the pandemic.

Projections from the US NHE fact sheet indicate an anticipated average growth rate in national health expenditure of 5.4 percent between 2022 and 2031. This rate is expected to surpass the average GDP growth, projected at 4.6 percent during the same period.

Consequently, there’s a projected rise in the health spending share of GDP from 18.2 percent in 2021 to 19.6 percent in 2031. This trend underscores the significance of healthcare as a driver of economic activity and investment.

Trend from the past six decades highlight NHE as a percent of GDP peaking in 2020 due to the impact of COVID-19:

Data source: CMS.gov; Image Source: © 2024 Krish Capital Pty.Ltd

Furthermore, Medicaid enrollment is anticipated to decline from its peak of USD 90.4 million in 2022 to USD 81.1 million by 2025, attributed to states disenrolling beneficiaries who are no longer eligible for coverage. Additionally, the proportion of the population with insurance coverage is expected to reach 90.5% by 2031. With a higher proportion of the population projected to have insurance coverage by 2031, insurance providers can anticipate a more stable and expanded market, leading to increased market penetration and potential growth opportunities.

McKinsey & Company forecasts a robust growth trajectory for the US healthcare industry’s profit pools, projecting a compound annual growth rate (CAGR) of 7 percent. This surge is anticipated to propel profit pools from USD 583 billion in 2022 to USD 819 billion by 2027.

Due to significant challenges in 2023, including higher inflation rates and labor shortages, profit pools remained under pressure. Nevertheless, a turnaround is anticipated, commencing in 2024. This rebound is expected to be driven by strategic initiatives such as margin and cost optimization, along with incremental increases in reimbursement rates. These measures are supposed to bolster profitability and stimulate growth within the sector, signaling a positive outlook for the healthcare industry in the coming years.

One major catalyst expected to drive revolutionary changes in the healthcare industry is the increasing adoption of artificial intelligence (AI) by streamlining existing processes and pioneering more efficient ones.

AI Adoption: A Potential Game Changer

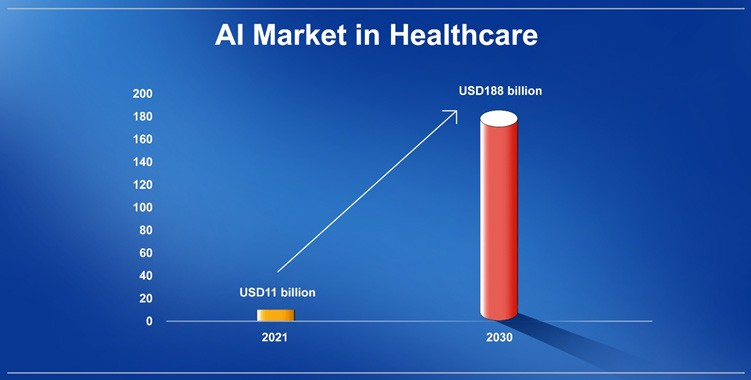

A working paper from the National Bureau of Economic Research underscores the potential impact of implementing today’s technologies, suggesting that AI adoption

within the next five years could lead to savings of 5-10 percent of healthcare expenditure, equating to an annual sum of USD 200 billion to USD 360 billion, all while maintaining quality and accessibility.

Meanwhile, Statista reports that the global AI market within healthcare, valued at USD 11 billion in 2021, is projected to surge to USD 188 billion by 2030.

Data source: Statista; Image Source: © 2024 Krish Capital Pty.Ltd

In a notable example, US healthcare giant Moderna (NASDAQ: MRNA) is prioritizing AI. In April 2024, Moderna revealed its ongoing collaboration with OpenAI aimed at advancing the application of mRNA medicine. This partnership began in early 2023 with the introduction of Moderna’s own instance of ChatGPT, called mChat.

Following the adoption of ChatGPT Enterprise, Moderna has swiftly deployed over 750 GPTs throughout the organization, enhancing automation and productivity across various functions. Moderna reduced its operating expenses by USD 795 million from 1Q23 to 1Q24, showcasing the tangible benefits of integrating AI technologies into its operations.

Equity Market Performance and Future Outlook

The MSCI USA Health Care Index has provided net returns of approximately 12% in the past five years, lagging the MSCI USA index, which has generated returns of around 15%, indicating the underperformance of the healthcare sector.

However, on a positive note, the current price-to-earnings (P/E) ratio of the healthcare sector stands at 29.23x, surpassing the forward P/E of 18.83x, implying an anticipated earnings growth in the healthcare sector relative to its current earnings level. This forward-looking perspective may reflect optimism regarding the sector’s future performance.

Likewise, a report from BlackRock highlights a brighter outlook for the healthcare

sector in 2024. The report forecasts that healthcare will lead in 12-month forward earnings growth compared to other sectors, with year-over-year sales growth closely trailing behind consumer discretionary and information technology.

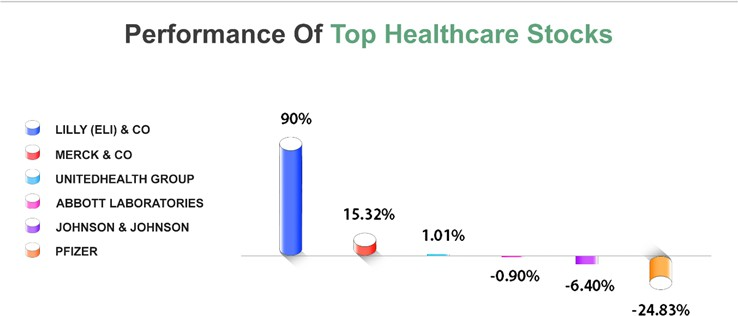

Data source: Refinitiv as of 30-05-2024; Image Source: © 2024 Krish Capital Pty.Ltd

Over the past year, some of the top healthcare stocks by market capitalization have displayed varying performance. Eli Lilly & Co., the leading stock in the S&P 500 Health Care sector, notably excelled, driven by its diabetes and obesity treatments. Conversely, while Merck’s oncology segment, notably Keytruda, contributed to its revenue growth, other healthcare giants are grappling with a lack of breakthroughs, indicating underlying turmoil in the sector.

Conclusion

The US healthcare industry is undergoing profound transformation, with AI set to drive cost reduction and efficiency improvements. Despite varied stock performance, optimistic projections for future earnings growth signal a positive outlook for the sector amid ongoing challenges and uncertainties.

Disclaimer – The information available on this website is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.