UK : 63, St Mary Axe, London, United Kingdom, EC3A 8AA

AU : Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

Email Us Mon-Fri, 10:00 AM to 6:00 PMMarkets Soar as Trump Reclaims Presidency: What Lies Ahead?

Donald Trump made a stunning political return, reclaiming the presidency just 4 years after losing his bid for re-election. His victory marks a turning point for American leadership, raising questions about the future of democratic institutions and international relations. For capital markets, Trump’s second term could present notable opportunities, especially for sectors aligned with his economic agenda, deregulation efforts, and “America First” trade policies.

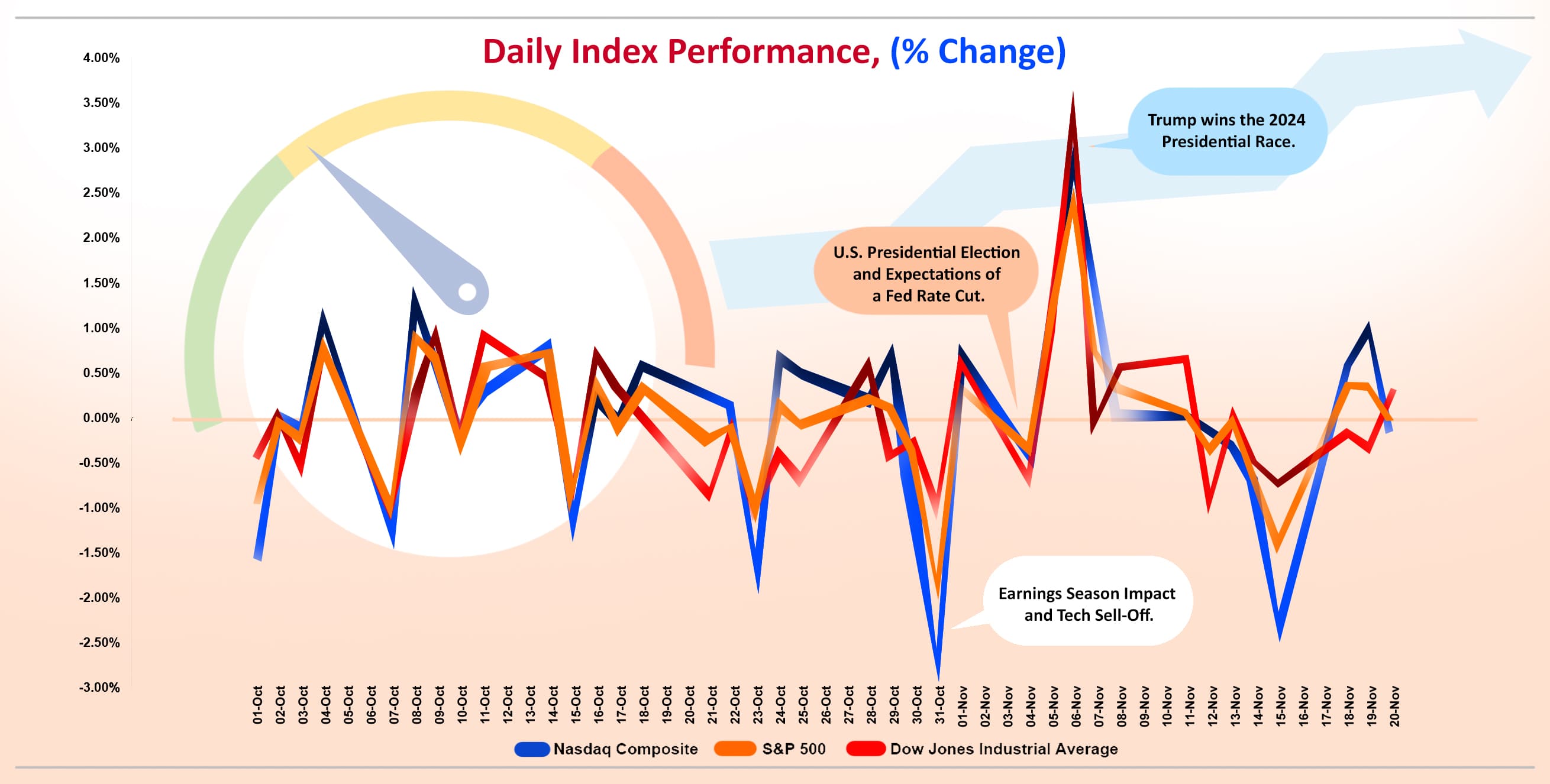

The stock market rallied to record highs on 11th November 2024, with the Nasdaq closing above19,000, Dow Jones Industrial Average closing above 44,000 and S&P 500 settling above the 6,000 mark for the first time.

After the U.S. election, investors are feeling more confident and have been buying up stocks. With the election now over, investors get a sense of relief as they believe Trump’s win could lead to better business regulations and more deals, giving furtherlegs to the ongoing market rally.

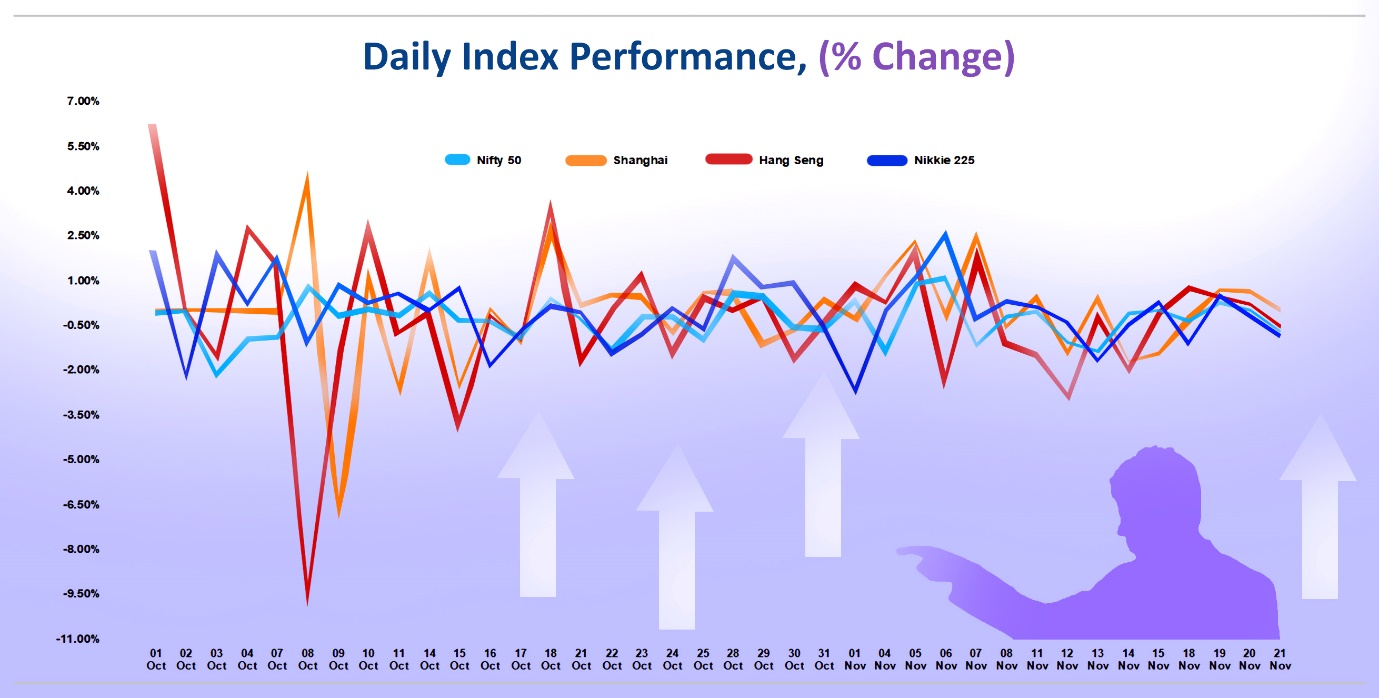

Data source: REFINITIV; Image Source:© 2024 Krish Capital Pty.Ltd; Analysis: Haanuwise (1st Oct 2024 to 20th Nov 2024)

Key Market Reaction

U.S. STOCK MARKET

The S&P 500, Dow Jones, and Nasdaq all reached new all-time highs, driven by hopes that Trump’s policies would create a business-friendly environment and lead to stronger economic growth. ongoing market rally.

How Trump's Victory Could Impact Industries

TECHNOLOGY INDUSTRY

• Tech stocks could benefit from a potential reduction in antitrust regulations, allowing big players like Google, Apple, and Amazon to grow further. Additionally, advancements in artificial intelligence could boost the sector, with the U.S. seeking dominance over China.

• Trade tariffs and restrictions, particularly on semiconductors like those produced by Nvidia, could negatively impact the industry. Policies aimed at limiting U.S. semiconductor production could also harm growth.

RETAIL INDUSTRY

• Trump’s proposed tax cuts could stimulate consumer spending, benefiting retailers. Some businesses have already shifted their supply chains away from China, helping reduce trade risks.

• Tariffs on imported goods, especially from China, could increase product costs. This could pressure retailers’ profit margins and lead to higher prices, potentially resulting in consumer dissatisfaction.

Energy Industry

• Traditional fossil fuel companies (e.g., oil and natural gas producers) may see growth due to Trump’s push for increased domestic drilling. Oilfield service and pipeline companies could profit from expanded drilling projects.

• Clean energy companies could struggle if tax incentives and subsidies for renewable energy are reduced, slowing growth in the green energy sector.

Health Care Industry

• Fewer regulations may encourage mergers and acquisitions within the healthcare sector. Insurance companies could benefit from less oversight, and some pharmaceutical companies might face less scrutiny over pricing.

• Efforts to dismantle or alter the Affordable Care Act could impact health insurers. Anti-vaccine sentiments could also introduce unpredictability in the approval of drugs and vaccines.

Automobiles Industry

• Reduced regulatory burdens, such as the rollback of emissions standards, could help automakers like General Motors and Ford sell larger, more profitable vehicles. Less pressure to sell electric vehicles could ease financial strains on manufacturers.

• Tariffs on imported vehicles, particularly from Mexico, could increase production costs for automakers. The reduction of electric vehicle tax credits could impact sales of EVs.

Financial Industry

• Lighter financial regulations could benefit banks, especially if the economy grows and leads to increased demand for loans. Investment banks might see a rise in deal-making activities, boosting profits.

• While regulations may ease, economic downturns or instability could still present risks for financial institutions.

Predicting the U.S. Dollar’s Next Move

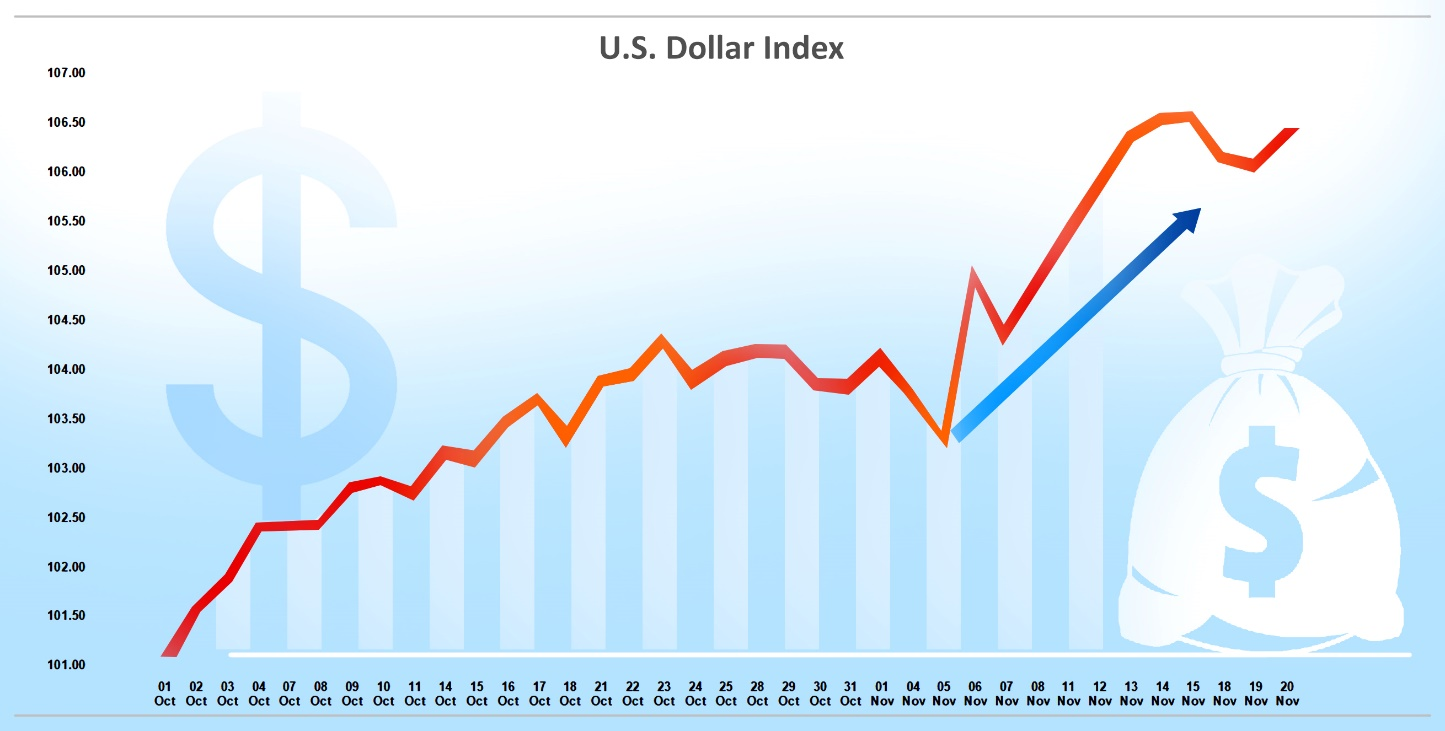

• On November 13, 2024, the U.S. Dollar surpassed its April 16 high against major currencies, including the British pound, Euro, and Japanese yen. This movement was driven by October’s U.S. inflation data, which matched market expectations, and the results of U.S. presidential election. Donald Trump’s victory fuelled expectations of inflationary tariffs and other policy measures under his administration.

• Expectations of Trump’s tax cuts and the potential for higher interest rates from the Federal Reserve have led to predictions that his tariffs could increase demand for the U.S. dollar compared to other currencies. Meanwhile, tax cuts could increase the deficit and push Treasury yields higher.,

• Trump’s victory, combined with a robust U.S. economy and favourable economic data, has boosted the dollar’s value, with the U.S. Dollar Index anticipated to reach $107.

Data source: Nasdaq; Image Source:© 2024 Krish Capital Pty.Ltd; Analysis: Haanuwise (1st Oct 2024 to 20th Nov 2024)

Bond Market Update

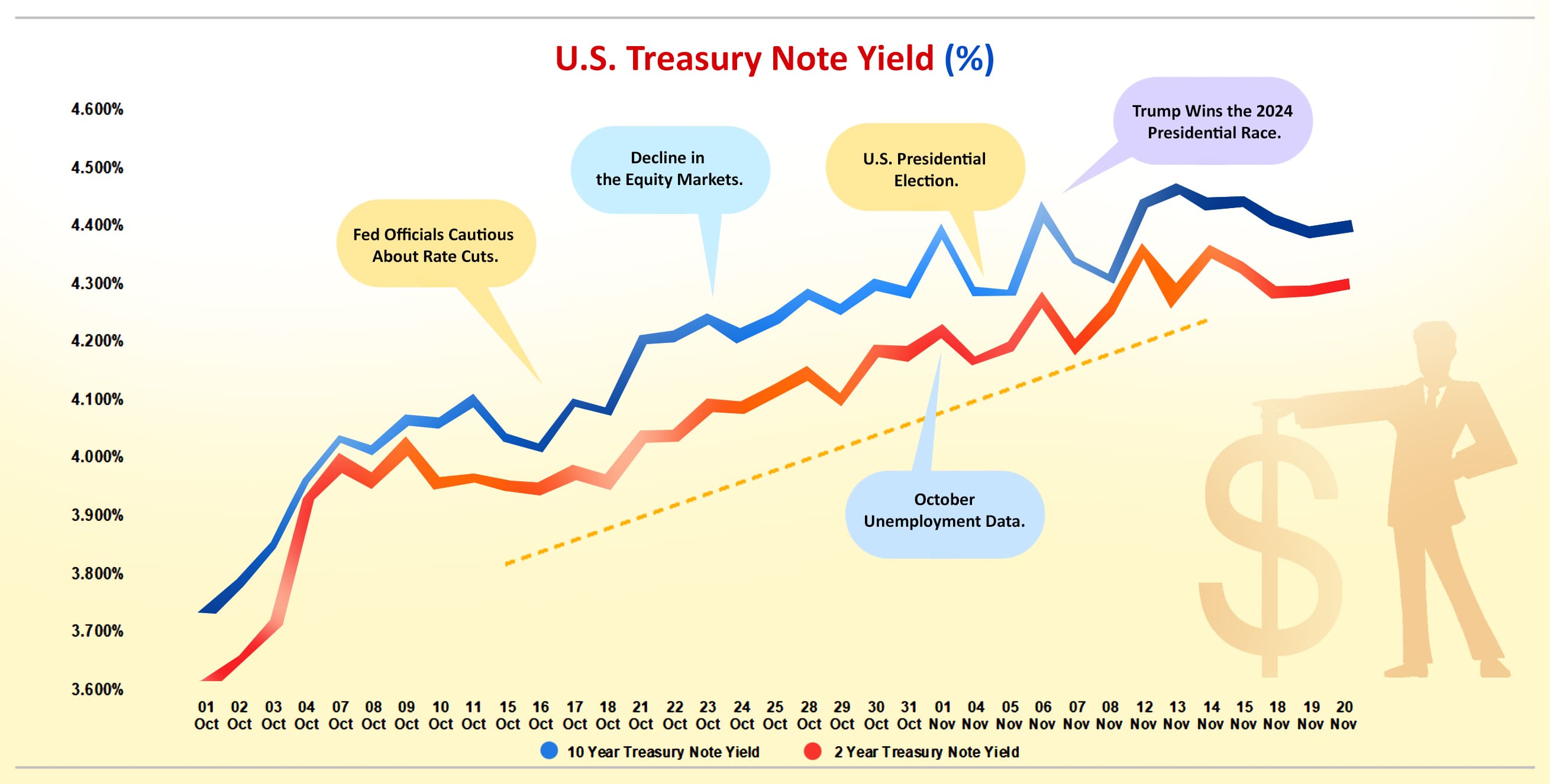

• On November 20, 2024, the 10-year Treasury yield soared to its highest level since July, driven by investor expectations that a Trump presidency could stimulate economic growth and increase fiscal spending.

• On November 14, 2024, Fed Chair Powell highlighted that robust U.S. economic growth suggests there is no immediate need for interest rate cuts. As a result, investors may see higher rates to continue in the near future. driving an increase in Treasury yields.

• Donald Trump’s election victory has led to an increase in bond yields since late September, driven by concerns that his policies may spark inflation and worsen fiscal deficits and government debt. Looking forward, while inflation risks may rise, the overall impact on the U.S. bond market will depend on the timing and sequence of his policy implementation, especially in relation to tariffs.

Data source: FRED; Image Source:© 2024 Krish Capital Pty.Ltd; Analysis: Haanuwise (1st Oct 2024 to 20th Nov 2024) 3:21 AM EST 11/20/24

Bitcoin Set to Cross $100,000 Milestone

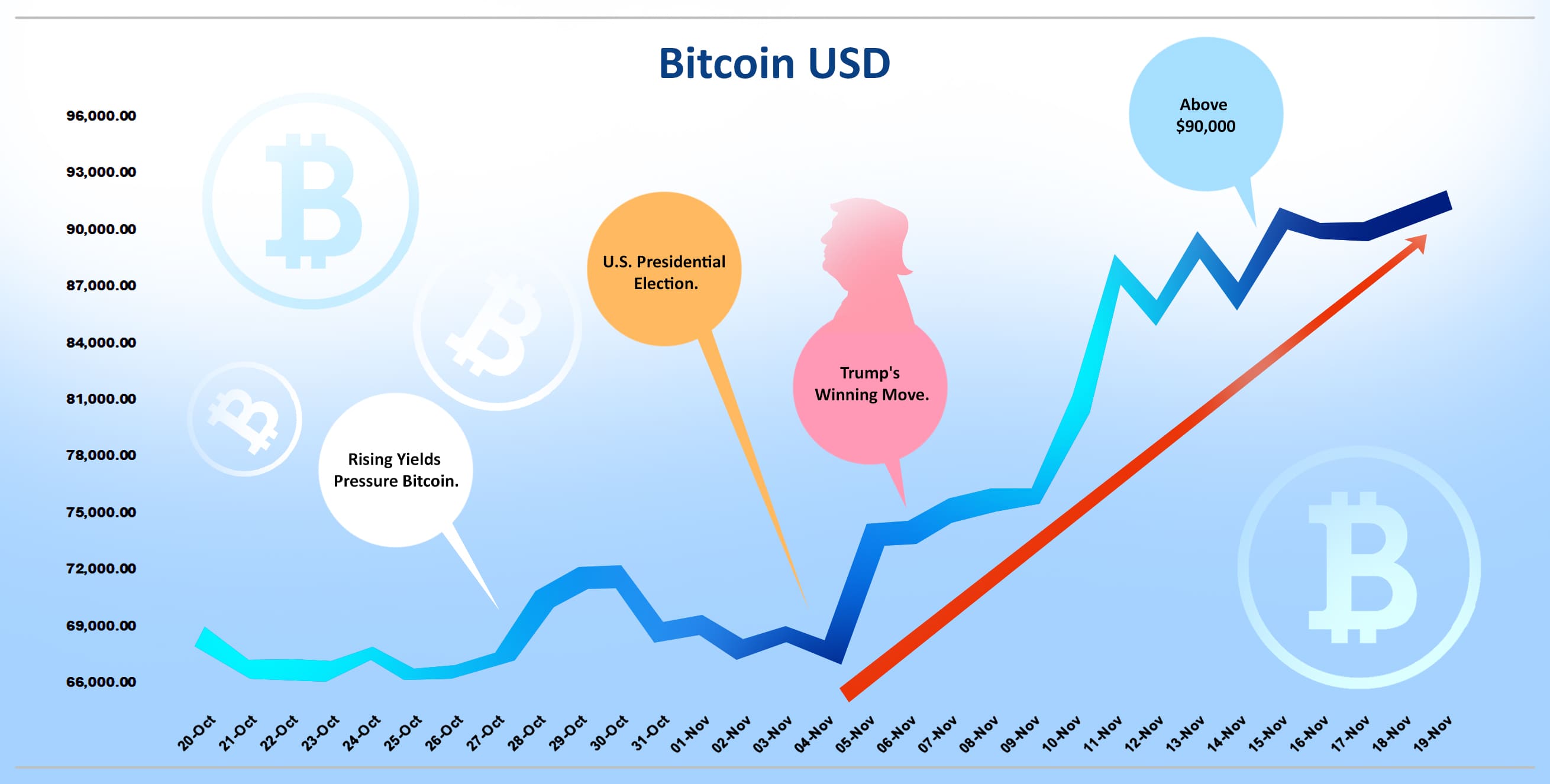

• Bitcoin recorded all time high $99,617 in November 2024. Donald Trump’s social media company was in discussions to acquire the crypto trading platform Bakkt, fueling expectations of a cryptocurrency-friendly environment under a potential Trump administration.

• Cryptocurrencies have surged since the U.S. election on November 5, as traders believed President-elect Trump’s stance on digital assets will differ significantly from the Biden administration. While President Biden’s administration, under SEC Chairman Gary Gensler, pursued stricter regulations and enforcement actions against crypto companies, Trump is expected to create a more favourable environment for the industry. This contrast has contributed to optimism in the crypto market.

• Trump’s pro-business stance and focus on innovation have boosted optimism in the cryptocurrency market, while Elon Musk’s ongoing support for Bitcoin has stoked inflows to this digital currency.

• Based on market events, Trump’s victory in the presidential race, positive news surrounding cryptocurrencies, and technical analysis, it is expected that Bitcoin could cross above the $100,000 mark before the end of 2024.

Data source: Nasdaq; Image Source:© 2024 Krish Capital Pty.Ltd; Analysis: Haanuwise (20th Oct 2024 to 19th Nov 2024)

Impact On Global Economy

• Trump’s “America First” approach to international relations often generates uncertainty in global markets. His unpredictable stance on trade deals, tariffs, and international alliances can contribute to periods of economic volatility. While his policies tend to prioritize short-term benefits for the U.S., they can destabilize the global economy, particularly if they disrupt established trade relationships or escalate geopolitical tensions.

• Trump could escalate trade conflicts, particularly with China and the European Union. His protectionist trade policies, including proposed tariffs and trade barriers aimed at reducing the U.S. trade deficit, could provoke retaliatory actions from other countries. This may lead to slower global trade, higher costs, and a potential economic slowdown. In a worst-case scenario, prolonged trade disputes could disrupt international supply chains and dampen global economic growth.

• During his first term, Trump pushed for reshoring efforts and sought to reduce dependence on overseas supply chains, especially in relation to China. If he continues this policy, it could lead to further disruptions, particularly for industries that rely on Asian manufacturing. This may result in higher production costs for businesses worldwide, especially in sectors such as technology, automotive, and consumer goods.

Data source: REFINITIV; Image Source:© 2024 Krish Capital Pty.Ltd; Analysis: Haanuwise (1st Oct 2024 to 20th Nov 2024)

Impact On Major Economies

China

• Following Trump’s victory, Chinese markets may face concerns due to the possibility of increased tariffs, sanctions, and trade restrictions. Stocks, especially those of manufacturing and tech companies like Huawei, could experience volatility. The Chinese market might see a decline as trade tensions intensify.

India

• Indian stocks, especially in sectors like defence, technology, and pharmaceuticals, may experience growth as stronger ties with the U.S. are likely to support industries such as IT and defence. However, short-term volatility could arise due to uncertainties surrounding trade policies, particularly in the IT sector.

• Over the long term, Indian markets may see steady growth, driven by increased foreign investment in technology and services, particularly as the country reduces its dependence on China for manufacturing.

Europe

• European markets may respond unpredictably to Trump’s victory, with nations like Germany and France, which have considerable trade ties with the U.S., facing potential challenges from tariffs and trade disputes. The automotive sector could be particularly impacted, and Trump’s position on Brexit might add further strain on European unity, contributing to increased market volatility.

Japan

• Japanese stocks may experience volatility based on the outcome of renegotiated trade agreements. While automakers may face challenges, companies in the technology sector could see modest gains.

South Korea

• South Korea’s economy, which depends significantly on exports to both the U.S. and China, may see varied market movements. While Trump’s position on North Korea could be seen as favourable for the country, ongoing trade tensions may create uncertainties in trade relations.

ASEAN Countries

• ASEAN countries like Vietnam, Indonesia, and Malaysia could experience positive stock movements as companies move their supply chains from China to Southeast Asia. However, the impact could vary by country depending on how Trump’s trade policies affect their exports.

• Manufacturing and export-driven sectors may see modest stock price increases, but overall market reactions will differ across the region.

Australia

• Australia’s stock market could experience pressure due to its close economic ties with both the U.S. and China. If the U.S.-China trade conflict escalates, Australian exporters and resource sectors may face negative market impacts.

• Australia’s strong relationship with the U.S. could offer some protection, particularly for industries like defence and natural resources.

Global Economy Outlook

After a Trump victory, the outlook for the global stock market and economy would be shaped by a mix of his domestic policies and the broader international economic environment.

Positive Outlook

Strengthened U.S. Economy

• Pro-Business Policies: Trump’s focus on tax cuts, deregulation, and a business-friendly environment could fuel growth in the U.S. economy. Lower corporate taxes and reduced regulatory burdens could boost corporate profits, encourage investment, and stimulate job creation. The financial and energy sectors could benefit from these changes.

• Infrastructure Investment: Trump’s promises to invest in infrastructure could spur demand in construction, steel, and related industries, potentially boosting stock prices in these sectors. It could also create job opportunities and stimulate local economies in the U.S.

Favourable Trade Deals for Some Countries

• Bilateral Trade Deals: Trump’s preference for renegotiating trade agreements on a bilateral basis could benefit some countries by securing more favourable terms for trade with the U.S. While this might negatively affect others, countries like Japan and India, which have a closer relationship with the U.S., could benefit from stronger economic ties.

• Supply Chain Shifts: As Trump’s trade policies could lead to businesses seeking alternatives to China for manufacturing, countries in Southeast Asia (e.g., Vietnam, Malaysia) may see increased investment, as companies look to diversify their supply chains away from China.

Negative Outlook

Trade Tensions and Global Trade Disruptions

• Trade Wars: Trump’s protectionist stance, which includes tariffs on Chinese goods and threats to impose tariffs on other countries, could escalate trade wars. This would disrupt global supply chains, hurt businesses dependent on international markets, and increase prices for consumers worldwide. Countries heavily reliant on trade with the U.S. or China (e.g., Mexico, the EU) could see slower growth or even recession if tensions intensify.

• Impact on Emerging Markets: Emerging markets, particularly in Asia and Latin America, could suffer from reduced access to U.S. markets or higher tariffs. These countries often rely on exports to the U.S. and would be negatively impacted by trade restrictions or market volatility linked to Trump’s policies.

Global Economic Uncertainty and Volatility:

• Market Volatility: The uncertainty surrounding Trump’s policies, particularly in trade, foreign relations, and healthcare, could lead to significant volatility in global stock markets. Investors may become more cautious, and risk assets could be negatively impacted by global trade disruptions or economic instability.

• Fluctuations in Currency Markets: Trump’s policies, especially his stance on trade and tariffs, could lead to fluctuations in global currency markets. Countries heavily dependent on exports could face currency depreciation as trade tensions escalate, making their products more expensive in international markets.

Rising Global Debt and Economic Instability

• Increasing U.S. Debt: Trump’s proposed tax cuts and infrastructure spending plans could lead to increased national debt, raising concerns about fiscal sustainability. A higher debt burden could lead to higher interest rates, both in the U.S. and globally, potentially slowing economic growth.

• Financial Instability: In the global context, higher debt levels in both developed and emerging economies could contribute to financial instability. Countries that have been borrowing to finance growth may face higher borrowing costs if global interest rates rise due to fiscal pressures in the U.S. or elsewhere.

Conclusion

Donald Trump’s return to the presidency marks a pivotal moment in U.S. politics and the global economy. While his pro-business policies and deregulation efforts could drive market growth, they also carry risks of heightened trade tensions and global economic volatility. Investors, industries, and nations worldwide must navigate this new era with caution, balancing opportunities with uncertainties. As markets adjust to Trump’s leadership, the long-term impact of his policies on economic stability and international relations remains to be seen.

Disclaimer – The information available on this website is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.