UK : 63, St Mary Axe, London, United Kingdom, EC3A 8AA

AU : Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

Email Us Mon-Fri, 10:00 AM to 6:00 PMGlobal Market Outlook

.png)

Steady Global Growth Projected

Central Banks face a difficult challenge in balancing inflation control with economic growth, leading to varied actions in September. While some Central Banks reduced interest rates to stimulate growth, others tightened monetary policy to combat persistent inflation. Globally, headline inflation is nearing target levels, core inflation remains high. The OECD’s latest Interim Economic Outlook suggests resilient global growth through the first half of 2024, driven by strong trade, improving real incomes, and a generally more accommodative monetary stance. Despite this positive momentum, risks persist.

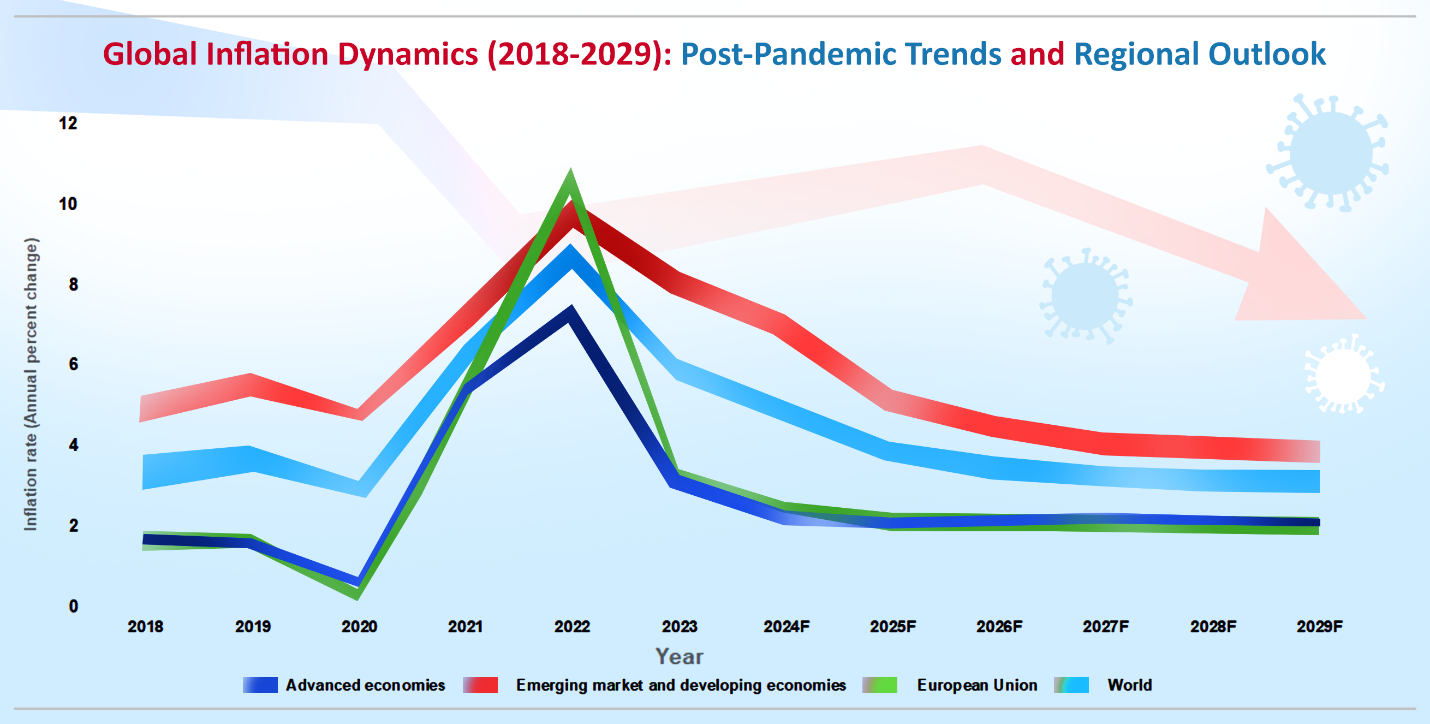

Global Inflation Trends: Progress, Regional Variations, And Future Challenges

Data source: International Monetary Fund, Inflation rate, end of period consumer prices (Annual percent change), Image Source:© 2024 Krish Capital Pty.Ltd

Central Banks have made significant progress in reducing global inflation, which peaked at 9.4% in July 2022, the highest level since 2008, and has since fallen to 2.9%. This reduction has been widespread, with 90% of countries seeing lower inflation than in mid-2022. However, global inflation remains 0.7 percentage points above pre-pandemic levels, and over 40% of inflation-targeting countries still have inflation exceeding target ranges. While Central Banks in major economies may begin to cut interest rates in the near future, they are unlikely to make significant reductions until inflation is firmly on track to return to target levels. As a result, monetary policy will remain restrictive, leading to continued tight credit conditions for emerging markets and developing economies (EMDEs). Inflation dynamics have varied across regions. In Europe and Central Asia, inflation surged before declining sharply, largely due to the impacts of the Russian invasion of Ukraine on food and energy prices. In contrast, East Asia and Pacific regions saw more stable inflation, aided by subsidies and persistent spare capacity. Globally, falling commodity prices (down nearly 40% between mid-2022 and mid-2023) have helped reduce inflation, though services inflation remains high in advanced economies.

Global Financial Conditions: Easing Trends Amid Persistent Inflation And High Interest Rates

Global financial conditions have generally eased since last year, driven by declines in risk premia despite still-high interest rates. Central banks in major advanced economies are expected to gradually lower policy rates, although real interest rates will continue to pose a challenge to economic activity, albeit to a lesser extent over time. Projections for policy rates have been volatile, reflecting ongoing inflationary pressures and, in the U.S., strong economic performance. Government bond yields remain above pre-pandemic levels, with advanced economy equity valuations, particularly in the U.S., rising due to optimism around AI-driven productivity gains. Risk appetite improved early in the year, but was tempered in April by inflation concerns and geopolitical tensions. Corporate credit risk perceptions remain low, although sectors like office real estate are facing challenges due to post-pandemic shifts in work patterns. Corporate credit spreads are still below pre-pandemic levels in both the U.S. and euro area.

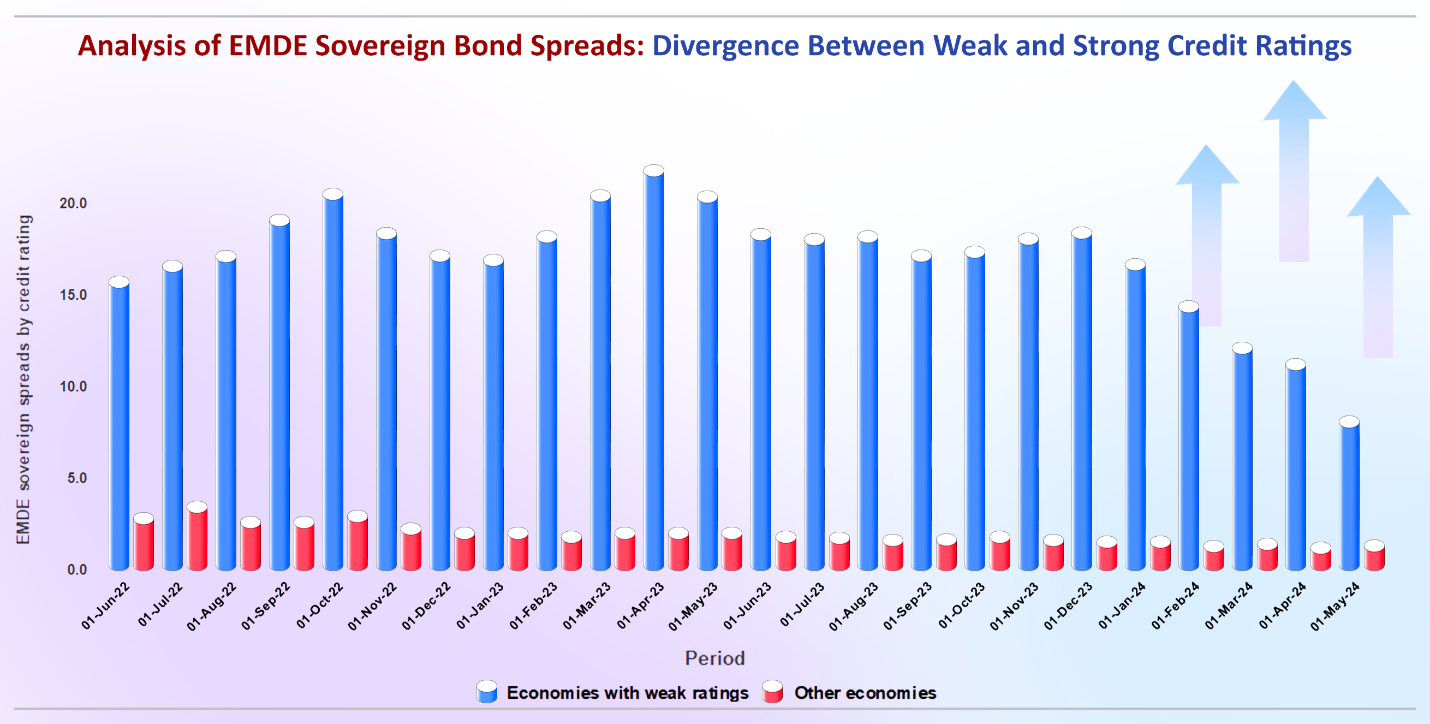

Data source: World Bank; Image Source:© 2024 Krish Capital Pty.Ltd

In the first quarter of 2024, financial conditions in emerging markets and developing economies (EMDEs) eased, driven by expectations of looser advanced-economy monetary policies, improving global investor sentiment, and ongoing rate cuts in large EMDEs. However, conditions became less accommodative in the second quarter as U.S. dollar strength and reduced expectations of U.S. rate cuts led to debt and equity outflows. Sovereign spreads in middle-income EMDEs have fallen below pre-pandemic levels, reflecting investor confidence, though spreads remain high in EMDEs with weaker credit ratings. Financial stress remains a concern for around 40% of EMDEs, particularly those with weak credit ratings or high debt distress risks. Countries with political instability and substantial post-pandemic debt burdens, especially low-income, unrated nations, face severe financial strains due to rising debt-service costs and slow economic recovery.

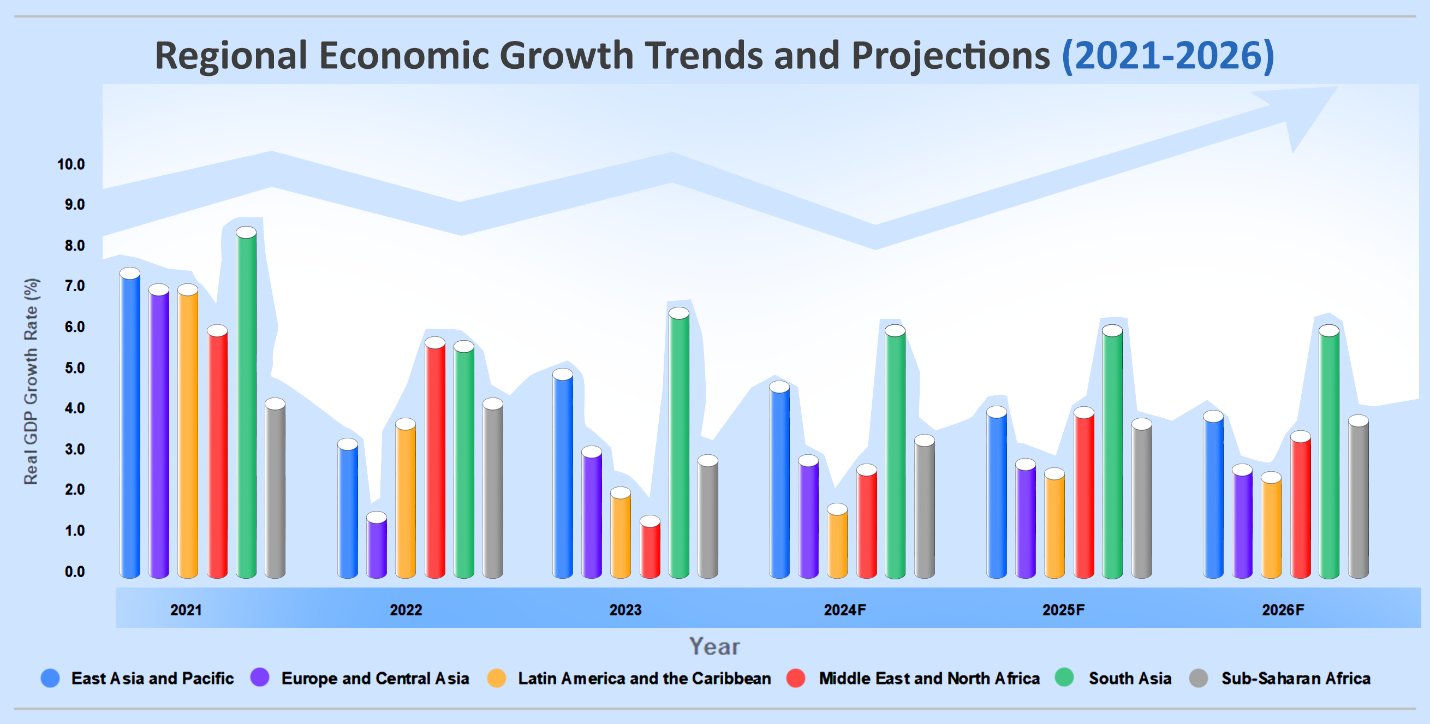

Data source: World Bank; Image Source:© 2024 Krish Capital Pty.Ltd

Addressing Global Growth Challenges: The Path To Productivity And Sustainable Economic Policies

GDP estimates confirm robust periodic growth, especially in Middle East & North Africa and South Asia, fueled by strong consumer spending and business investment. The Bureau of Economic Analysis’ annual revision showed that real GDP growth over the past four quarters was 3% higher than a year ago. Revisions through 2023 and into mid-2024 reflect stronger consumer spending, particularly on services, and higher business investment, especially in factories and equipment. However, government spending and net exports contributed more negatively than previously reported, particularly in 2023. Improving growth prospects and boosting productivity are essential to addressing global challenges, including rebuilding fiscal buffers, managing aging populations, transitioning to a sustainable economy, and enhancing resilience. However, growth is projected to remain weak, with the IMF projecting a 3.1% global growth rate for the next five years, the lowest in decades. This reflects a weaker outlook for China and deteriorating prospects in regions like Latin America and the European Union.

In response to external competition and structural weaknesses, many countries are adopting industrial and trade policies to protect domestic industries. However, these policies often stem from macroeconomic imbalances, such as weak demand in China or excessive demand in the U.S. While these measures may provide short-term gains, they can lead to retaliation and fail to sustain long-term improvements in living standards. Such policies should be used cautiously, focusing on specific market failures or national security concerns.

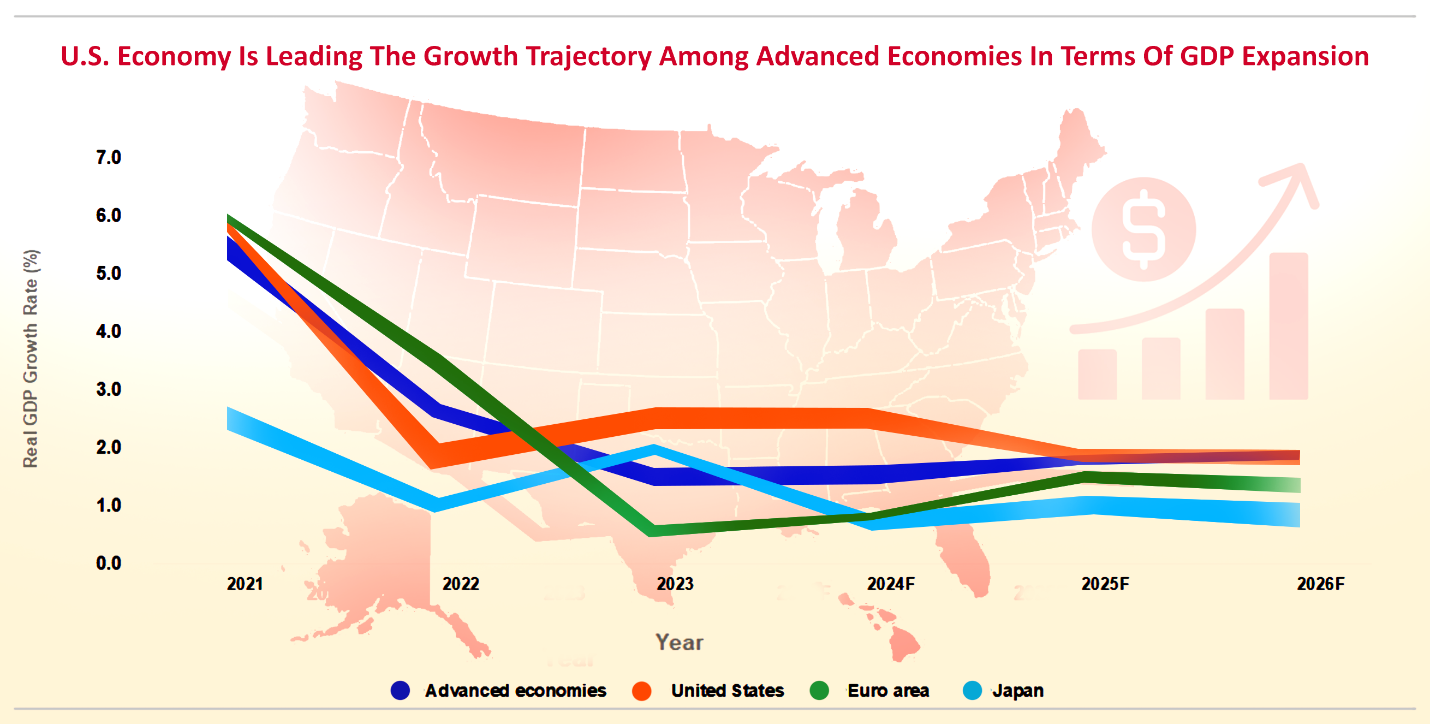

Data source: World Bank; Image Source:© 2024 Krish Capital Pty.Ltd

In September, Central Banks around the world implemented significant monetary policy changes. The US Federal Reserve delivered a notable interest rate cut, reducing the target range for the Fed funds rate by 0.5 percentage points to 4.75–5%, the largest reduction since the pandemic. The European Central Bank (ECB) followed with a more cautious 25 basis-point cut to its deposit facility rate, reflecting downgraded economic forecasts for the eurozone. Similarly, China’s Central Bank initiated a broad stimulus, cutting reserve requirement ratios by 50 basis points and lowering the seven-day repo rate by 20 basis points to 1.5%, alongside reductions in deposit rates to support its struggling real estate sector. In contrast, Russia’s central bank raised its key rate by 100 basis points to 19%, following a previous tightening. Brazil’s central bank also raised its benchmark rate by 25 basis points to 10.75%, marking the start of a new tightening cycle after two years.

Data source: World Bank; Image Source:© 2024 Krish Capital Pty.Ltd

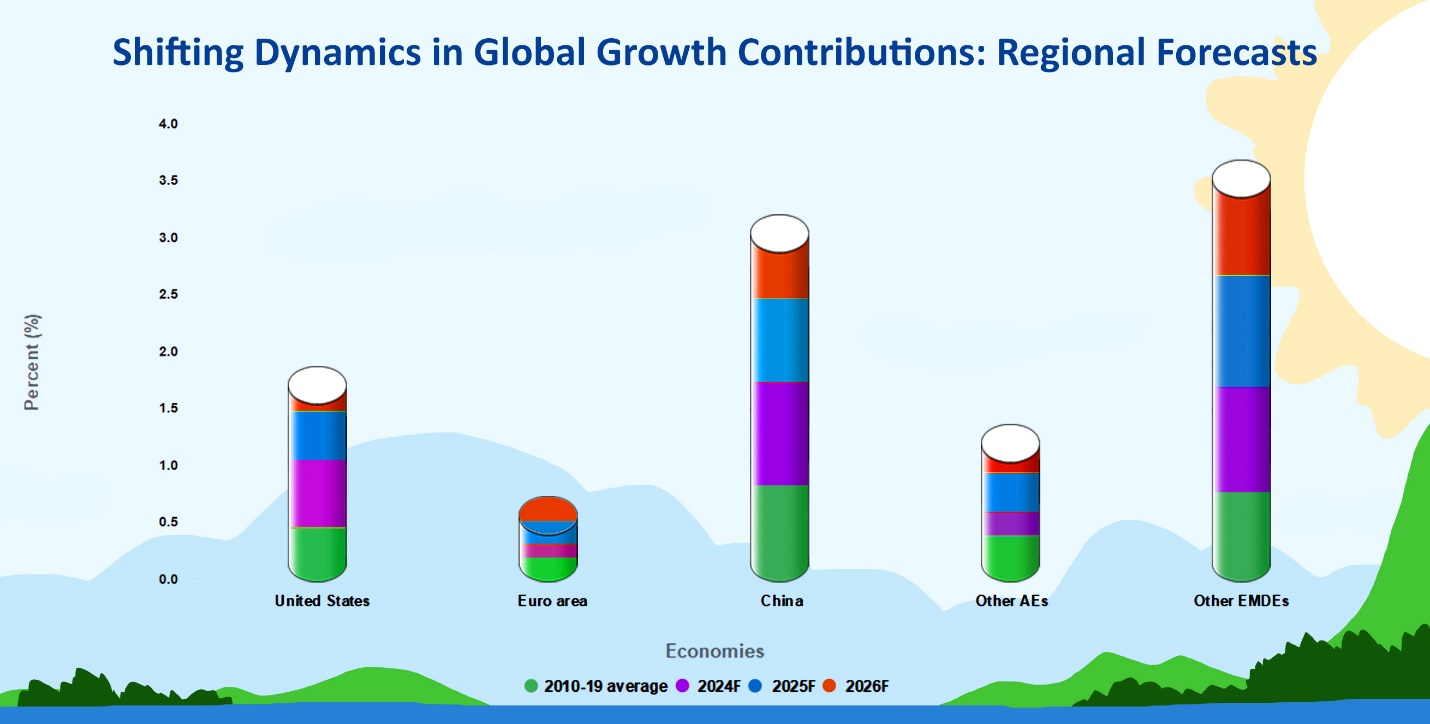

The data highlights the projected contributions to global growth across key regions from 2024 to 2026, compared to the 2010-2019 average. The United States is expected to contribute 0.6 percentage points in 2024, with a gradual decline to 0.4% by 2026. The Euro area’s contribution remains minimal, expected at 0.1% in 2024 and 0.2% in subsequent years. China’s contribution is expected to decrease slightly from 0.9% in 2024 to 0.7% by 2026. Other advanced economies (AEs) show a smaller contribution, while other emerging markets and developing economies (EMDEs) maintain steady growth contributions of around 0.9–1.0 percentage points throughout the period.

Domestic demand in many EMDEs is expected to improve in 2024, driven by a moderate recovery from high inflation, tight financial conditions, and weak industrial activity. However, aggregate EMDE growth is projected to decelerate slightly due to idiosyncratic challenges in large economies. Vulnerable economies, particularly low-income countries (LICs) and those affected by conflict, face worsening growth prospects. While global trade is recovering, mainly driven by goods trade, services trade growth is expected to slow, with tourism nearly returning to pre-pandemic levels. Overall, the trade outlook remains subdued, hindered by trade-restrictive measures and heightened policy uncertainty.

Data source: World Bank; Image Source:© 2024 Krish Capital Pty.Ltd

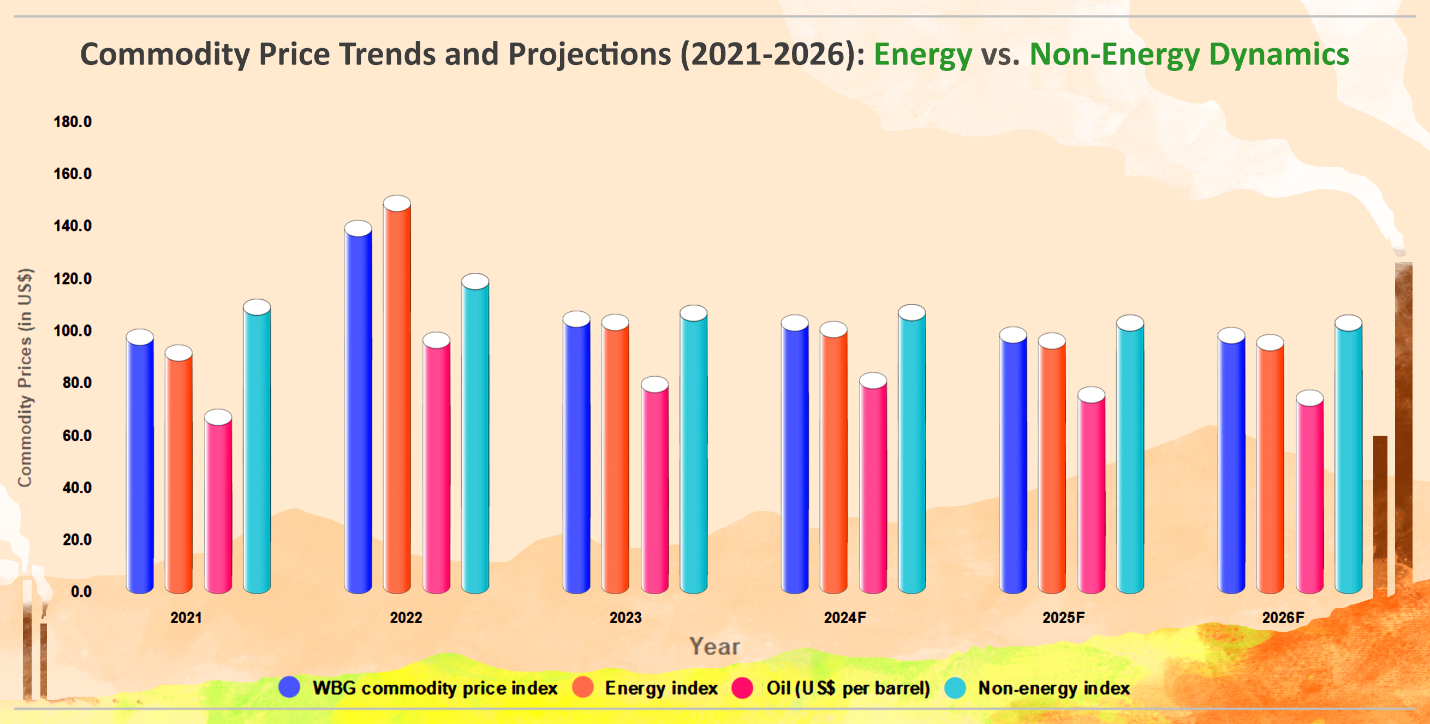

Since late 2023, aggregate commodity prices have risen, with average oil prices being slightly higher in 2024 due to a tight demand-supply balance amid ongoing geopolitical tensions. However, overall energy prices are projected to be marginally lower than last year, primarily due to decline in natural gas and coal prices, though they remain above pre-pandemic levels. Metal prices are forecasted to remain stable, supported by demand from clean energy investments and a recovery in global industrial activity, despite weaker real estate demand in China. Prices for edible food crops are expected to decline modestly, as markets for grains and other agricultural commodities remain well-supplied.

Conclusion

In conclusion, while the global economy shows signs of stabilization after years of negative shocks, growth is expected to remain modest at 2.6% in 2024, gradually rising to 2.7% in 2025-26. Inflation is projected to moderate, but more slowly than previously expected, and Central Banks are likely to maintain higher interest rates for an extended period. Emerging market and developing economies (EMDEs) will experience slower growth, and significant risks such as geopolitical tensions, trade fragmentation, and climate-related disasters persist. Policymakers must navigate these challenges while prioritizing green and digital transitions, addressing debt sustainability, and fostering long-term productivity, human capital, and gender equality to achieve sustainable development goals.

Disclaimer – The information available on this website is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.