UK : 63, St Mary Axe, London, United Kingdom, EC3A 8AA

AU : Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

Email Us Mon-Fri, 10:00 AM to 6:00 PMWealth Management Trends 2023

The global economy has been facing many headwinds as it transitions from the COVID era. Ultralow interest rates adopted by most central banks to stimulate their economies during the COVID-era showed its effects. As a result of this cost of funds came down, and money supply increased, resulting in record-high inflation in most of the country. In the US, consum- er prices soared 9.1 year-on-year (YoY) in June 2022, a four-decade high, and in the Euro Zone (the 19 countries that use the euro currency), annual inflation surged by 10.7%, also a 40-year high in October 2022. To bring down inflation, most of the Central Banks started moving rates northward, leading to a surge in bond yields and correction in equity markets.

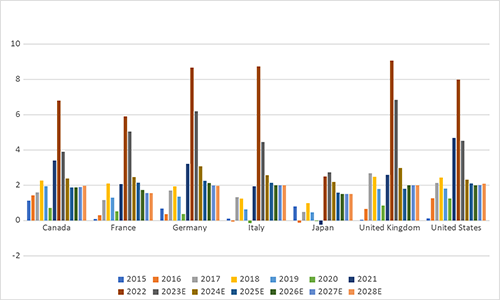

Inflation (Average Consumer Prices - % YoY)

Inflation Peaked in 2022, impacting equity markets, recovery on the way...

Source: IMF, estimated figures after 2022

These developments affected the Wealth Management Industry (WMI) along with some industry-specific issues like pressure on fund management fees (FMF), rising costs, shifting investor preferences for digital products and alternative assets, use of artificial intelligence (AI) to improve productivity.

To adapt to these changes, the WMI will have to change how they think, invest and operate. Surely, this transition will be difficult for the industry, but those striving through this phase will find opportunities to grow.

Here are key wealth management trends for 2023 and the year ahead:

1. Inflation Coming Down but Still a Long Way to Go

Even after 11 consecutive rate rises by the US Federal Reserve (Fed) since early 2022 that saw the key interest rate rising to 5.25%, the consumer inflation in the world’s biggest economy fell to 3.2% in this year to July but still above the Fed’s 2.0% target.

Earlier this month, in a speech to the Jackson Hole symposium in Wyoming, the US Federal Reserve Chairman Jerome Powell said the Central Bank will continue to raise interest rates if inflation remains high.

Rising rates not only put pressure on consumer spending and business capex, but also increase the odds of a recession.

Such a situation makes wealth managers’ tasks more difficult as they must protect their client’s wealth while simultaneously showing their acu- men to generate alpha.

2. Stock Market Outlook Still Remains Gloomy

All the three major stock indexes in the US--S&P 500, Dow Jones, and Nasdaq-- have re- bounded modestly from their 2022 lows. However, it is still difficult to predict the market trajectory for the rest of 2023 and 2024 as macroeconomic challenges persist.

.png)

NASDAQ index performance chart, Source: NASDAQ

All the three major stock indexes in the US--S&P 500, Dow Jones, and Nasdaq-- have rebounded modestly from their 2022 lows. However, it is still difficult to pre- dict the market trajectory for the rest of 2023 and 2024 as macroeconomic challenges persist.

Investors continue to remain concerned about high energy prices, high inflation and interest rates, a looming US recession, and several bank failures, giving sleepless nights to wealth managers and no reason to relax.

Wealth managers are finding it difficult to arrive at

a consensus about the near-term market trajectory amid competing forces. Most of the corporates have reported better-than-expected earnings for the Q2 of 2023 while markets have witnessed significant recov- ery amid hopes of an end to the rate hike cycle and, eventually, rate cuts.

3. Prudent Investment Strategies to Hedge Against Inflation, Economic Downturns

While equities provide long-term growth, bonds give stability and security to your portfolio, and alternative assets help you outperform the broader market by tapping emerging opportunities.

As consumers are still facing the inflation squeeze, finding a safe and reliable investment is a challenge.

Traditional assets like real estate, which witnessed massive price appreciation during the ultra-low interest rate scenario in the COVID era, are now coming off their peak amid rising interest rates. In such a situation, some of the proven investment strategies found favour with wealth managers.

Gold

Over the years, gold has proven its significance as a hedge against inflation and economic downturn. Investors typically buy this yellow metal as a hedge when they don’t feel confi- dent about the economic and stock market outlook.

Fund managers typically recommend a 5-10% allocation to gold in a diversified portfolio in such a situation.

Other than gold, wealth managers also prefer to stay with the USD as a hedge against in- flation. In October 2022, the US Dollar Index touched a level of over 113, when inflation was at its peak in most advanced countries.

.png)

Source: REFINITIV as on 4th September 2023

Gold has been one of the essential sentiment indicators related to the global economic and political situation since eternity. It is also one the attractive precious metal both from consumption and investment perspective as it plays a vital role in the human psyche. Over the past decade, this shining metal has gained almost 37.38% from USD 1412 to USD 1939 levels till 3rd Sep 2023. Besides, the US Dollar Index has moved up 27.82% from 81.42 to 104.06 levels.

.png)

Source: REFINITIV as on 4th September 2023

Defensive Stocks

When market outlook is uncertain, it is safe to find shelter in defensive stocks as their earnings and returns are relatively stable and consistent compared to other stocks. Utilities, Health Care and Consumer Staples are some of the defensive sectors which investors can consider.

As companies from these sectors cater to the day-to-day needs of consumers, such as food, electricity, and health, spending on these heads usually does not come down even in an economic downturn. Typically, consumers cut their spending on non-essential and discretionary items in an economic downturn.

Other than defensives, dividend stocks can be a good option for investors in a falling market as they provide an additional source of income in terms of dividend payouts.

Cash

When you are unsure about the near-term market outlook, one of the best things to do is to hold as much cash as possible. By holding cash, you get the flexibility to purchase growth and other stocks at discounted prices before the market bottoms out.

Bonds

In a rising interest rate scenario, wealth managers prefer to hold floating-rate bonds with shorter maturities as they are less volatile and reduce portfolio volatility. These assets pro- vide interest income, while other assets generally don’t do well.

4. Business Transformation with a Focus on Resource Optimisation.

Wealth management firms are restructuring their business models in multiple ways to strive through competition and increase their earnings as costs go up.

They are also preparing for a global recession, like impacting their profits. Here are some key initiatives that WMI is taking to prepare for a looming recession.

Increasing Focus on Alternatives

Wealth managers are increasingly targeting new high-net-worth (HNI) clients by offering alternative assets that provide high return potential, such as investments in private equity funds and private real estate that have lower correlation with traditional assets/markets.

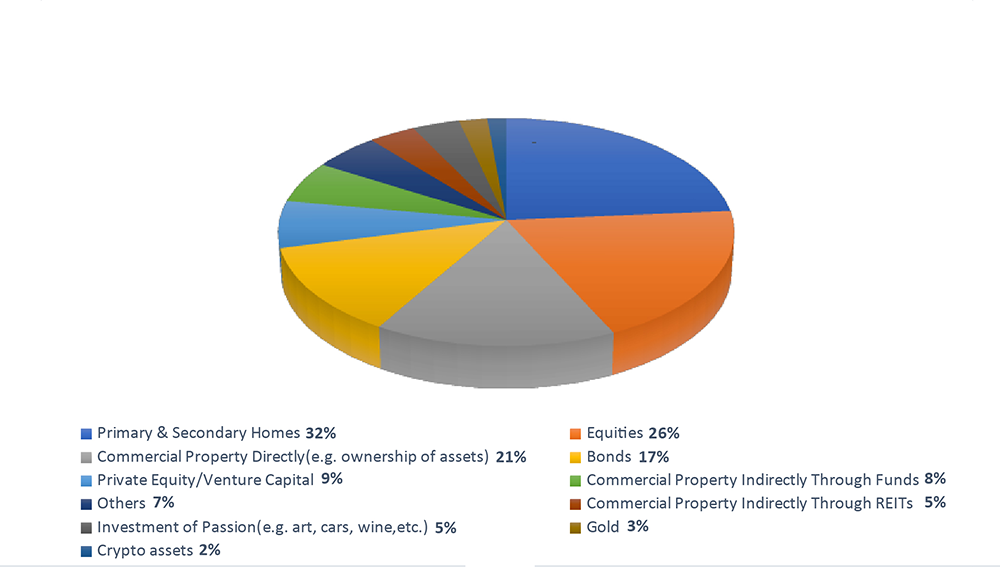

According to the recent Wealth Report 2023 Atti- tude Survey by Knight Frank, the portfolio break-up of the ultra-high net worth individuals can be viewed as below, where-in equities form a major portion of their investments.

Portfolio make-up On average what proportion of...total wealth is allocated to: Investable wealth is allocated to:

Source: Knight Frank Wealth Report 2023

According to a PWC report, alternative asset managers are reaching NHI clients through wealth managers as they look for innovative ways to retain these clients. Smaller wealth managers increasingly specialise in specific alternative assets to generate attractive re- turns for their clients.

Digital Transformation

In order to increase efficiency, boost growth, and cater to investor preference towards dig- ital engagement, wealth managers are focusing on digital transformation such as online onboarding of clients, online KYC and Demat account opening. For this, WMs are replac- ing their old systems with cloud-based technology and are adopting artificial intelligence (AI), and data analytics.

Advisers are also upskilling themselves so that they can use AI to complement their work.

Fight Against Fee Compression

Large players in the industry have cut their fees to retain clients, and this is putting pressure on smaller wealth managers to do the same.

But, some of the smaller players have managed to retain their clients without cutting their fees by creating more value for their clients. Some are developing expertise in their respective fields and can create value for their clients through their differentiated offerings. Clients don’t mind paying a little extra for that value addition and expertise.

Higher Focus on ESG

As governments and investors in most of countries are becoming environment conscious, the asset management industry is following a two-pronged transition into environmen- tal, social and governance (ESG). Wealth managers are incorporating ESG into investment

products and integrating ESG principles into their purpose, strategy and performance management.

A recent PWC report has projected that ESG AUM in the US will be more than double to USD 10.5 trillion in 2026 from USD 4.5 trillion in 2021. This will be supported by Inflation Reduction Act, which commits USD 390 billion to fight climate change.

To keep pace with the industry trend, wealth managers ensure that their operating mod- els are sound enough to adhere to the present environment to secure and retain clients.

5. Rebuilding Trust With Crypto Assets.

With a drastic fall in the prices of crypto assets, investors are finding it difficult to develop trust in these assets. Until this trust is rebuilt, crypto assets will unlikely reach their full potential and offer value to businesses.

Wealth managers can rebuild this trust by offering secure, quality hosted custody of these digital assets such that users become less prone to cyber hacks. At the same time, asset management firms engaged with these digital assets must understand the risks associated with digital asset service providers and how that risk affects investors.

Proper risk management at all levels can rebuild trust in digital assets. An independent audit of systems can ascertain the adequacy of risk management controls and procedures.

6.Focus on Developing Tech-Enabled Tailored Client Experience

Some wealth management firms focus on develop- ing tailored client experience, making optimal use of technology and human capital.

Even before the pandemic, wealth managers used technology to offer their clients personalised ser- vices. Now, technology adoption has accelerated with AI tools like ChatGPT.

Clients always expect their advisers to offer value beyond the traditional financial plan. So, to stay rel- evant, it is critical that advisers stay connected with their clients in a digitally enhanced way to drive trust and loyalty.

New technology makes doing more in less time and with fewer resources possible. AI tools can help wealth managers in research by summarising large data patterns to antici- pate future events, create rules, make good decisions, and communicate with others.

According to a Gartner report, 75% of organisations will use AI in their operations from a pilot to a permanent basis.

Most of the redundant work, like downloading statements, storing files, and emailing re- ports, can be automated using technology.

Wealth managers need accurate, up-to-date data to allow for faster decision-making. With AI-driven tools, they can aggregate data and show it to their clients in a presentable format. Clients across all age groups expect modern fintech from their advisers.

Clients should have easy and instant access to their portfolio details via cloud-based tech- nology. These features are no longer just additions; they are necessities.

7. Outsourcing Non-Core Functionalities.

It is neither easy nor essential to become an expert in everything. It only pays to gain expertise in some things. So, wealth management firms, mostly the smaller ones, focus on their core job—investing and client servicing— only and outsource most of the admin and operational work. This saves cost and increases efficiency.

Everything that is non-core and an additional cost for the business can be outsourced.

According to a Fidelity survey on outsourcing for wealth managers, those who outsourced more were more likely to report a growth in client and AUM.

8. Consolidation Is Set To Accelerate

The wave of consolidation in the wealth management industry is set to accelerate with bigger firms acquiring smaller efficient firms. This is a trend visible across countries. The number of private banks has been decreasing continuously across markets.

For example, in the US, 50% of the wealth managers in the Registered Investment Advisor (RIA) channel are affiliated with the largest 10% of RIAs. In Switzerland, the number of pri- vate banks has dropped from more than 150 in 2010 to nearly 90. Private equity has driven significant consolidation in the US and the UK among independent wealth managers and financial advisers.

Medium-sized and owner-led, smaller independent wealth managers prefer to get ac- quired by the larger ones amid higher costs and regulatory headwinds combined with the need for succession management.

Disclaimer – The information available on this website is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.