UK : 63, St Mary Axe, London, United Kingdom, EC3A 8AA

AU : Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

Email Us Mon-Fri, 10:00 AM to 6:00 PMUS Mortgage Sector Trends in 2023

For years, historically low interest rates have been the norm, making homeownership more affordable for many. However, the economic dynamics now have changed, and it's essential for potential homebuyers, current homeowners, and investors to understand the implications of the current trends.

Rising Mortgage Rates

The mortgage sector in the United States of America (USA) is in a state of flux, influenced by a huge range of factors, like government policies, changing consumer preferences and economic conditions. In 2023, many notable trends are building the landscape of the US mortgage sector. This blog post will provide a holistic overview of these trends as well as their impact on borrowers, lenders, and the real estate market.

After years of low interest rates, there has been a significant uptick in mortgage rates in 2023. The Federal Reserve's decision to tighten monetary policy addressing economic growth and inflation concerns has driven up the cost of borrowing. Consequently, borrowers may have to make higher monthly payments and may need to reevaluate their affordability.

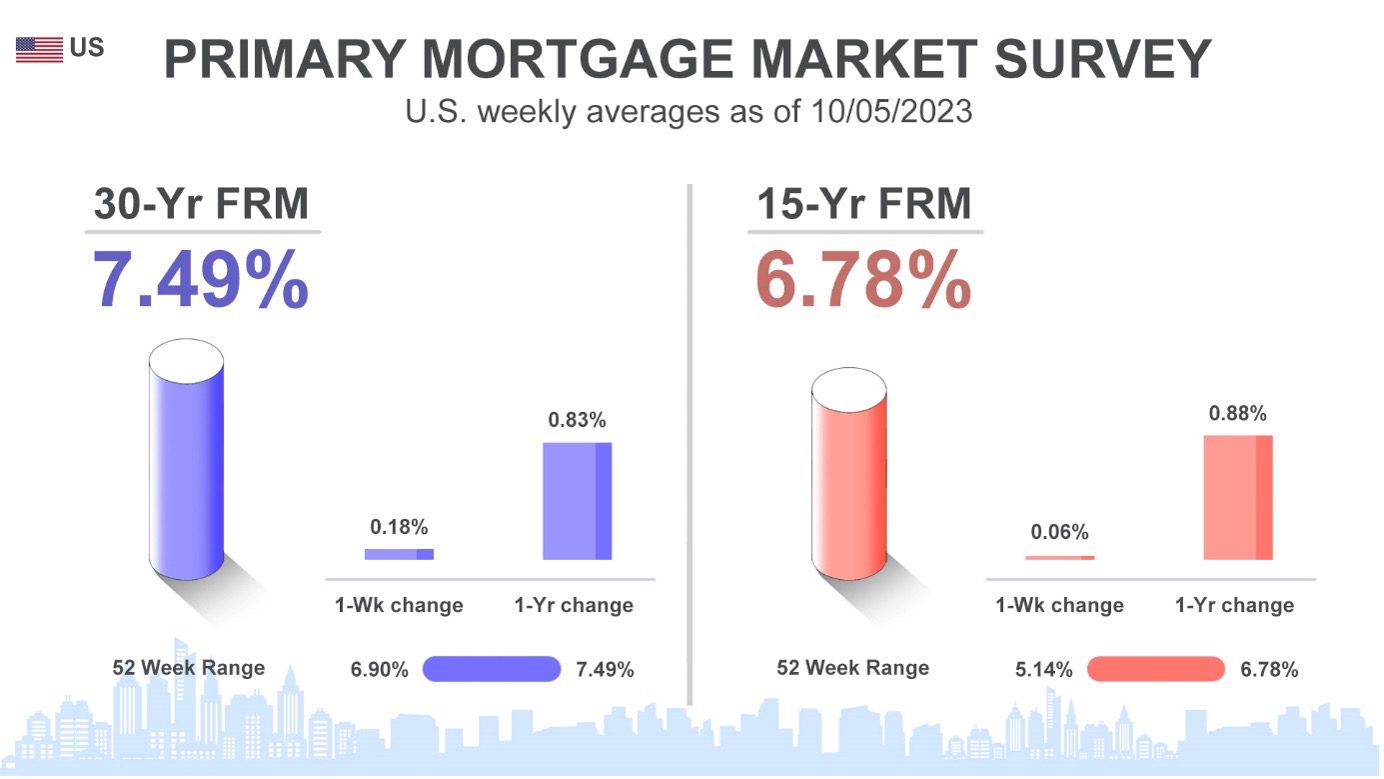

On an average, the interest rate for a three-decade fixed-rate mortgage in the US is 7.57% as of October 12, 2023, states Freddie Mac.

Rising mortgage rates mean that monthly mortgage payments will increase for both new homebuyers and existing homeowners with adjustable-rate mortgages (ARMs). Prospective buyers need to recalculate their budgets and ensure they can comfortably handle the higher payments.

Info source: Freddiemac.com, Infographic: © 2023 Krish Capital Pty. Ltd.

Home Prices and Sale

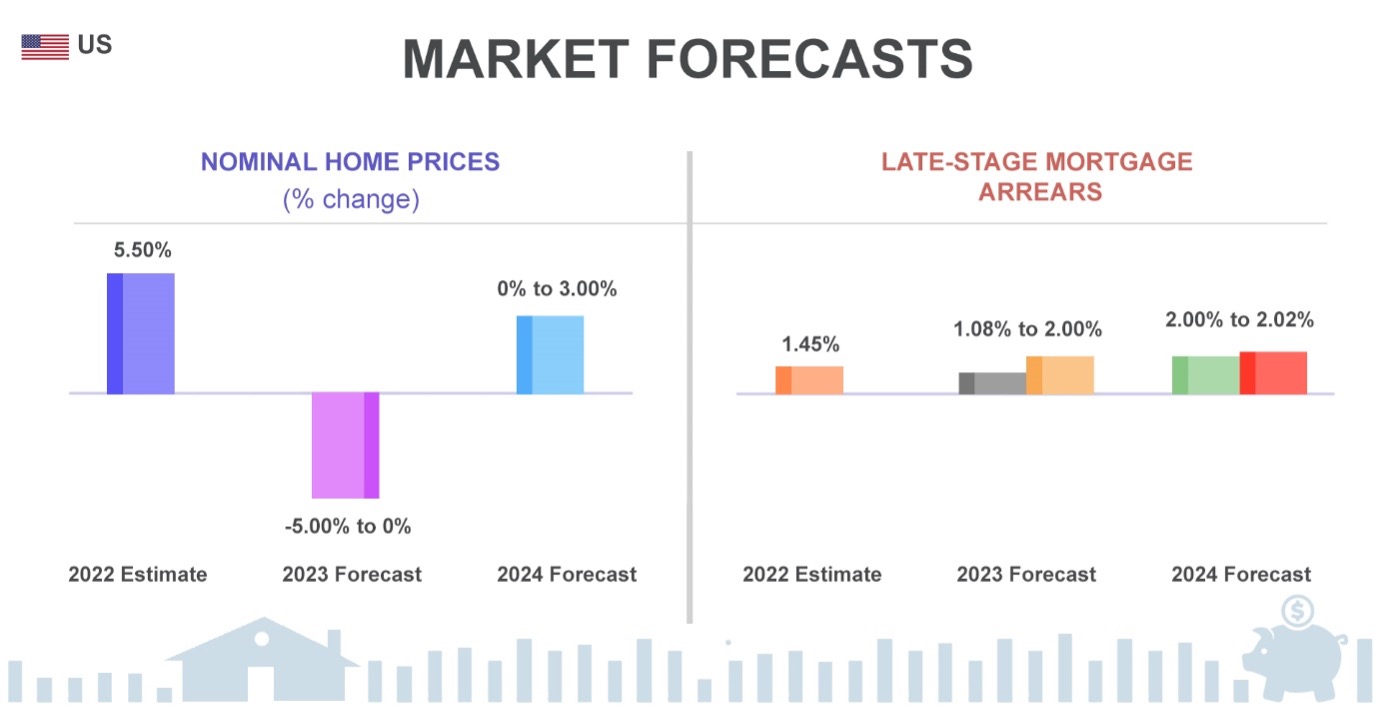

Home prices in the US continue to soar, though at a lesser speed as compared to previous months. This is likely because of multiple factors, including higher mortgage rates, rising inflation, and decreasing supply of homes for sale.

Notably, home sales are still higher than the pre-pandemic levels.

The National Association of Realtors (NAR) says, the median existing-home sales price in the US was US$406,700 in September 2023, up 1.9% from 2022. Existing-home sales fell 3.3% from August to a 4.16-million-unit seasonally adjusted annual rate, the lowest level in five months.

Info source: Fitch Ratings, Infographic: © 2023 Krish Capital Pty. Ltd.

Digital Transformation

The mortgage sector worldwide is witnessing a digital transformation, making the application and approval process more streamlined and convenient for borrowers. Increasingly, lenders are offering online application and approval processes, reducing paperwork and providing a more user-friendly experience. This shift is likely to prevail in 2023.

The trend of digital lenders for the housing sector in the United States is growing rapidly. In 2022, digital lenders originated over 20% of all mortgage loans in the US.

There are different reasons for the growth of digital lenders in the US housing sector. First, digital lenders offer a more convenient and efficient way to borrow money to buy a home. Borrowers can apply for a mortgage online and get approved for a loan in a matter of days, without going to a brick-and-mortar bank branch. Second, digital lenders offer more flexible lending options than traditional lenders. For example, digital lenders are more likely to approve mortgages for borrowers with non-traditional credit or who have a smaller down payment. Third, digital lenders are able to offer interest rates lower than traditional lenders. This is because digital lenders have lower overhead costs and are able to operate more efficiently.

The growth of digital lenders is having a positive impact on the US housing market. Digital lenders are making it easier for people to buy a home, which is helping to boost demand for housing. Digital lenders are also helping to make the housing market more affordable by offering lower interest rates and more flexible lending options.

The future of digital lending in the US housing sector is bright. As digital lenders continue to innovate and offer new products and services, they are likely to play an even larger role in the US housing market.

Mortgage delinquency due to unemployment

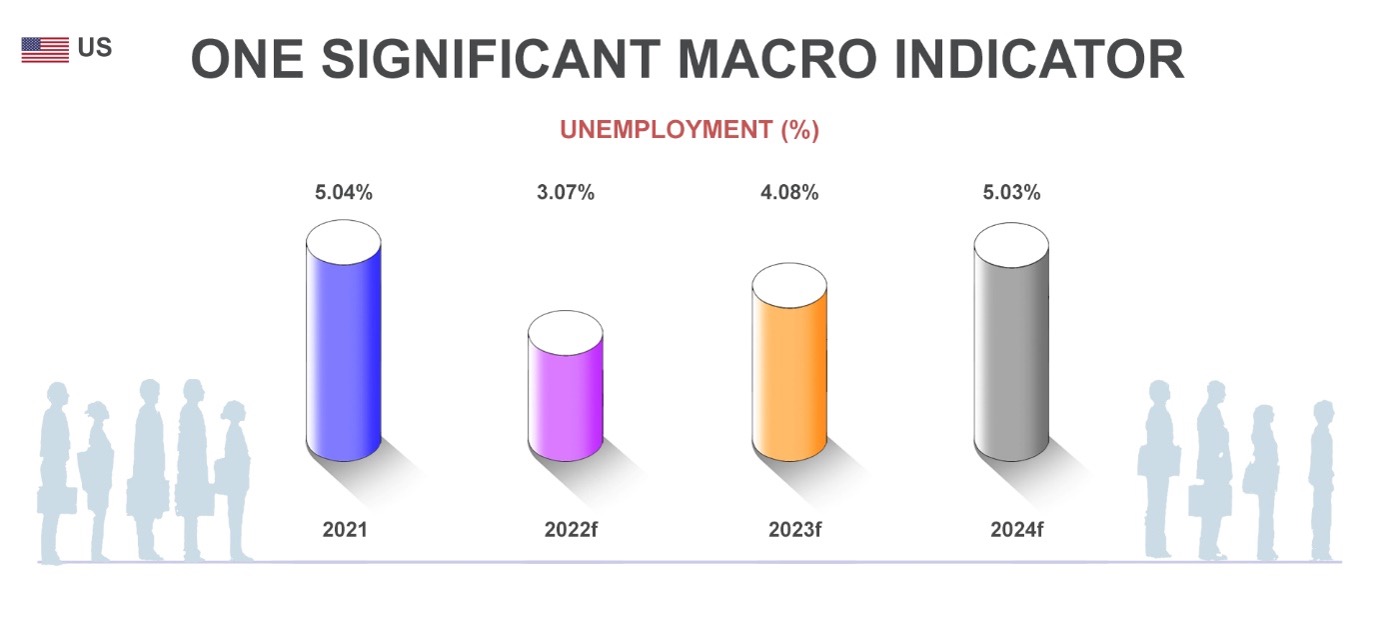

Unemployment can have a significant impact on mortgages in the United States. When people lose their jobs, they may have difficulty making their mortgage payments. This can lead to delinquency and foreclosure.

According to a study by the Federal Reserve Bank of Philadelphia, the unemployment rate has more impact on individual mortgage default rates. The study found that the average default rate for the employed is 2.4%, while for the unemployed, it is 8.5%.

The effect of unemployment on mortgages can vary depending on varied elements, including the severity of the unemployment crisis, the strength of the economy, and the availability of government assistance programs. However, unemployment can have a significant negative impact on mortgage payments and can lead to delinquency and foreclosure.

Info source: Fitch Ratings, Infographic: © 2023 Krish Capital Pty. Ltd.

Housing Initiatives

As the cost of housing continues to rise, there's growing concern about affordability. To address this issue, several government initiatives and private-sector efforts are aimed at making housing more accessible to a broader range of income levels. This includes affordable housing programs, down payment assistance, and innovative financing options.

Regulatory Changes

The mortgage sector remains subject to regulatory changes that impact lending practices, transparency, and consumer protection. Lenders must stay vigilant and adapt to evolving regulations, especially as they relate to loan origination, servicing, and disclosure requirements. Mortgage borrowers can expect greater protections and a more transparent process as a result of these changes.

and Alternative Lending

Fintech companies and alternative lenders continue to disrupt the traditional mortgage lending landscape. These tech-driven companies are often able to provide quicker approvals and more flexible lending options, appealing to a new generation of tech-savvy borrowers. As they gain prominence, traditional banks and mortgage companies are adapting to compete with these emerging players.

Refinancing Opportunities

Despite rising interest rates, some homeowners may find opportunities to refinance their existing mortgages. For those who purchased homes during the low-rate period, it's essential to assess whether refinancing can still provide benefits, such as lowering monthly payments or consolidating debt.

Conclusion

The US mortgage sector in 2023 is marked by change, adaptation, and innovation. As interest rates rise, the housing market shifts, and technology transforms lending practices, both borrowers and lenders must stay informed and agile. With increasing emphasis on affordability, regulation, and climate considerations, the mortgage sector continues to play a crucial role in the broader economic landscape, impacting millions of Americans seeking to achieve their homeownership dreams.

As the year progresses, it's vital for all stakeholders in the mortgage sector to monitor these trends closely and be prepared for potential opportunities and challenges that lie ahead.

Disclaimer – The information available on this website is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.