UK : 63, St Mary Axe, London, United Kingdom, EC3A 8AA

AU : Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

Email Us Mon-Fri, 10:00 AM to 6:00 PMUS Market Outlook 2024: Hopes for a Softer Landing

Image Source: Shutterstock.com

The Economic Resilience

Amid the tepid outlook, the US still commands a quality premium over other markets due to cash-rich megacap stocks. There is still some fiscal support working through the economy, together with excess savings built up in the pandemic. Some pandemic related disruptions are reversing with a rebound in auto production and sales. US student loan repayments may resume in the fourth quarter of 2023 which may drag the spending towards year end. Typically, there is a one-to-two-year lag in interest rate cuts and their impact on employment growth; the Fed started raising interest rates 18 months ago, indicating that a slowdown is likely to go forward due to this lag effect.

Homeowners are resilient as many of them locked in mortgage rates when they were below 4%, so they are not as vulnerable as they were in 2007-08 at the advent of GFC.

Key themes to watch.

- Central Bank Policy Lags - The Fed’s tightening moves over the past year and a half are likely to have a lag effect and it may be observed in the coming year as well. The resilience of the consumer market may absorb the impact.

- US government dysfunction - The dysfunction in the US government may lead to continued fiscal deficit worries and policy inaction. Fiscal shock absorbers are not available in the event of an economic downturn.

- Geopolitical concerns - War in Ukraine and the Middle East is a risk to the global economy and inflation. Recent oil spikes have so far not spread to the global economy.

- China’s Economy - China’s RE market has seen a significant drag on growth, putting severe pressure on corporate and local government balance sheets.

Structural Shift Underway

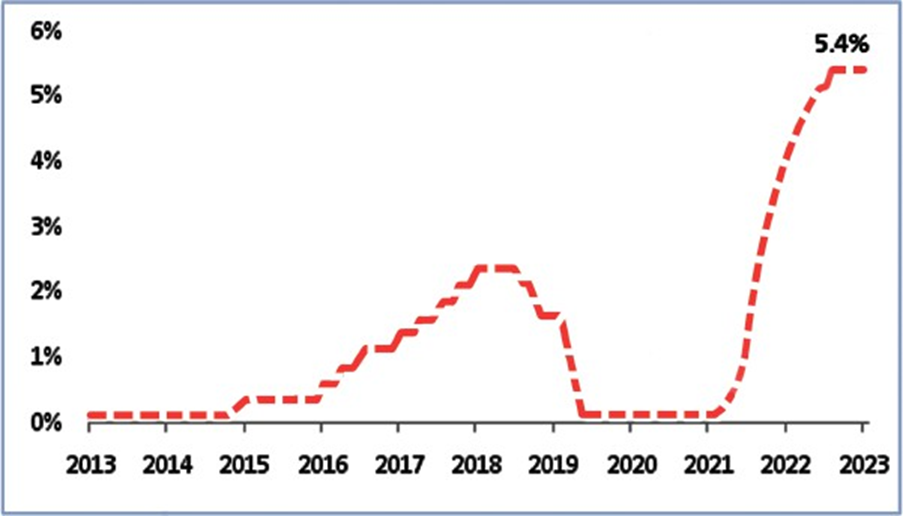

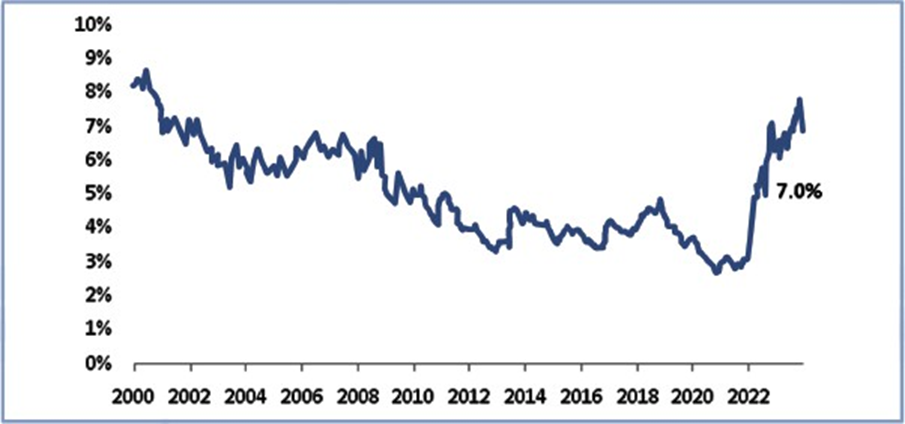

The markets have been flip-flopping between hopes for a soft economic landing and fears of yet higher rates that may ultimately lead to recession. This has created volatility in the 10 year Fed rates which has currently hit a level of 5.4%. The move in consumer spending trends drove up inflation by creating a mismatch between what people wanted to buy and what the economy was set up to produce. The mismatch is now resolving and as a result, inflation has been falling. The effects of pandemic shocks have receded, and a worker shortage has become a more structured subject issue.

Exhibit 1: Fed Rate, more than the longer-term average of 4.25%

Data Source: 10Y Benchmark yield, FOMC

Image Source: © 2024 Krish Capital Pty. Ltd

Is the big ease coming in 2024?

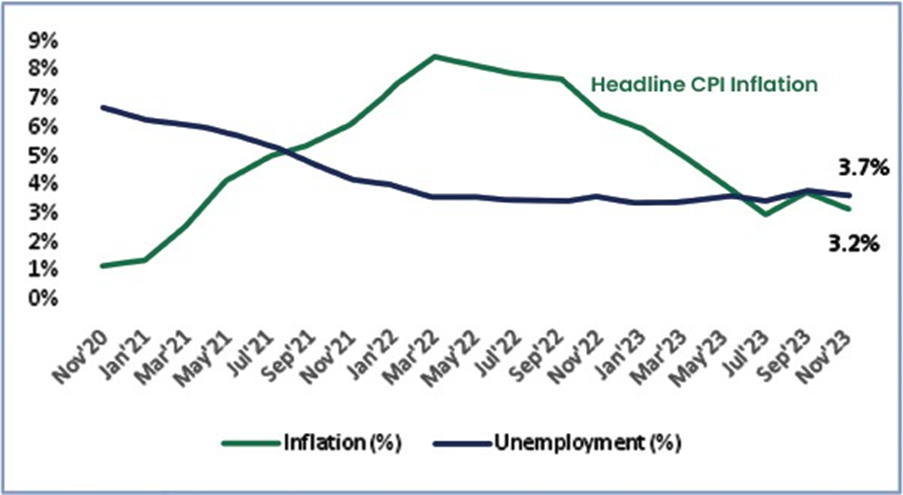

Inflation has declined substantially from its peak last year. Over the last three months, the core Personal Consumption Expenditure (PCE) increased at a 2.3% annualized rate, last year this was 5.5%. Goods prices have come down as the supply side bottlenecks ease and goods demand normalized with respect to demand for services. Wage growth has declined due to the steady loosening of the labor market. The most likely environment through 2024 is that inflation may stay above theFed’s 2% target of 2025.

Exhibit 2: A rare positive correlation since the 1990's.

Data Source:US Bureau of Labor statistics

Image Source: © 2024 Krish Capital Pty. Ltd

Chart Takeaway:Inflation and employment both are keeping low and in same trend, generally they remain inversely correlated this may indicate inflation rise was also largely contributed by supply chain disruptions.

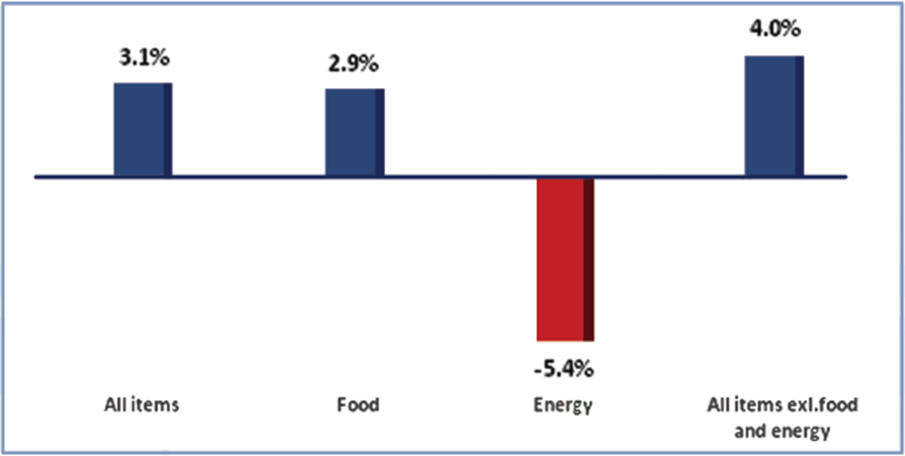

Exhibit 3: The heavy energy prices downweighing.

Data source: US Bureau of Labor Statistics

Image Source: © 2024 Krish Capital Pty. Ltd

Chart Takeaway:The downward pressure from lower energy prices has partially offset the acceleration of core items as can be seen from the chart above.

Equity Market Outlook- A Neutral Play

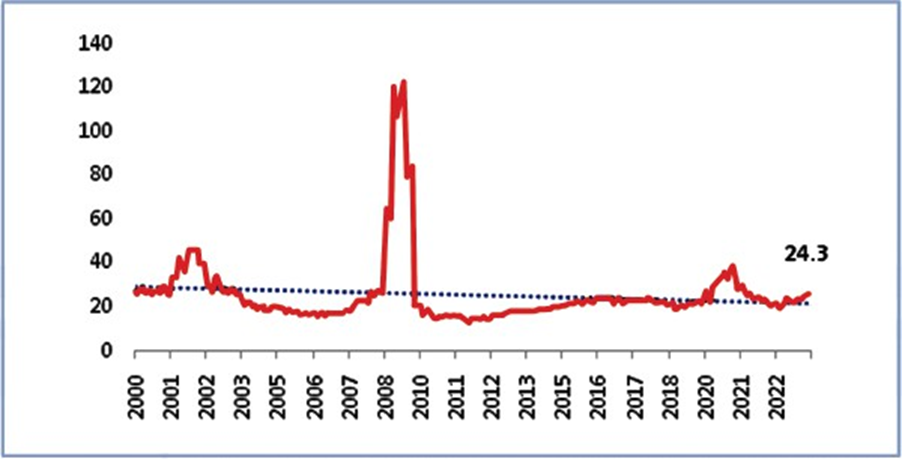

In 2022, the S&P 500 slid close to 20% in the wake of the Fed’s decision to rapidly hike interest rates.However, markets advanced in 2023 recovering some lost ground. Equity concentration in S&P 500of tech mega stocks has risen to levels never seen since the 1970’s, this trend has been generally observed when managers get cautious before a market slowdown.

The equity markets are richly valued while the geopolitical and political risks remain elevated. The Fed may reduce its balance sheet, liquidity can get contracted. Among US households as well, excess liquidity and cash-like assets have fallen from a peak of $3.4 trillion to $1T and may largely be exhausted in the second half of 2024.

The street consensus estimates stand at 2-3% earnings growth in the US heavy weight S&P 500 going forward through the year 2024. The market may see low growth levels amid a weak economic growth outlook. The market's volatility may be higher as compared to last year due to looming geopolitical scenarios.The US dollar (USD) is expected to remain volatile but may remain at elevated levels and can even reach new highs.

Exhibit 4. S&P Valuation trend so far.

Data Source: S&P 500 Price/Earnings, Refinitiv

Image Source: © 2024 Krish Capital Pty. Ltd

Chart Takeaway: The current Index P/E stands at 24. Historically, the median P/E remains at 17.9. The broader market is richly valued.

The Equities market view for 2024 looks sluggish but a neutral performance can be expected as the AI theme shows some alpha potential.

Harnessing Mega Caps

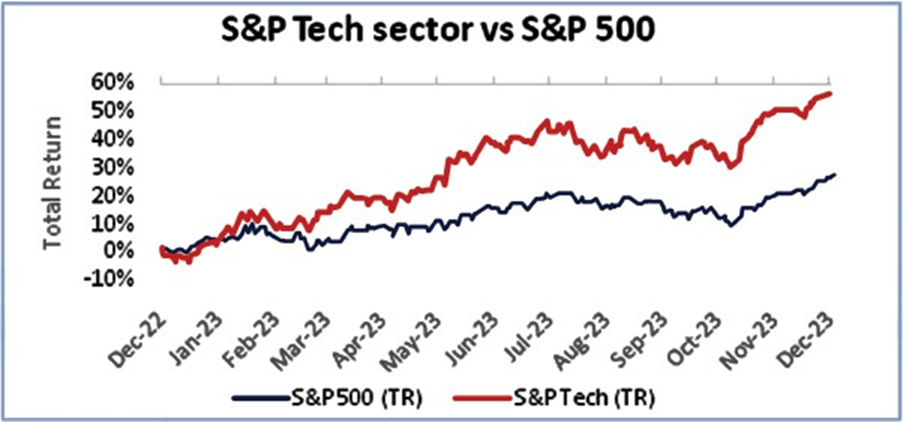

Exhibit 5: Tech Outperformance relative to broader US market.

Data Source: S&P Global

Image Source: © 2024 Krish Capital Pty. Ltd

Chart Takeaway: Investor enthusiasm for AI and digital tech has pushed U.S. tech stocks to easily outperform the broader market in 2023.

The digital disruption and artificial intelligence (AI) have been key forces shaping the markets. We think this reflects how quickly markets embrace such fundamental shifts in market outlook. This may create new investment opportunities and can be the key driver for long-term growth and profitability shifts.

Consumers continue to spend in 2023.

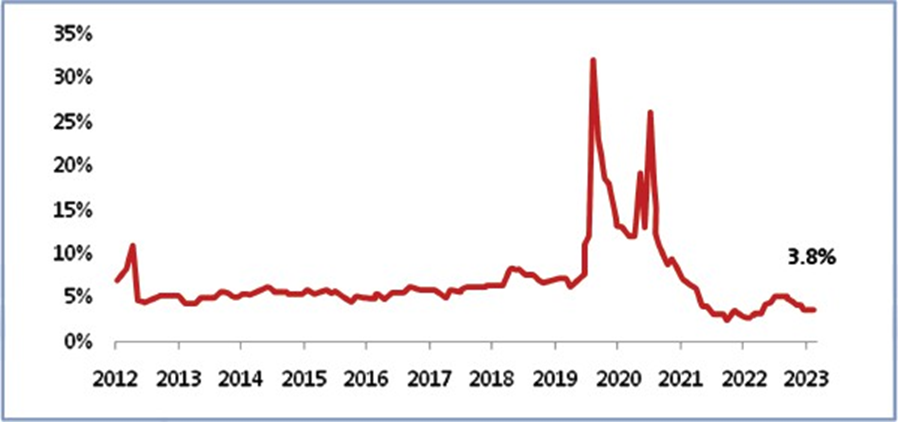

Exhibit 6. Huge savings decline from the pandemic levels.

Data Source: US personal savings rate, FRED

Image Source: © 2024 Krish Capital Pty. Ltd

Chart Takeaway:The US personal savings rate has declined from pandemic high levels and is below the historical average of 8.78% owing to high inflation, slower wage growth, and good consumer spending which has kept the economy away from recession.

Going forward it looks difficult for the savings rate to revive as the expected fed rate cuts will promote the consumption of goods and services, housing, and purchase on credits.

2024 - A better year to purchase a home?

Demand for housing was incredibly strong throughout 2020 and 2021 as record-low mortgage rates and high personal savings helped create a home-buying frenzy. But times changed, rising rates and persistently high home prices dragged the mortgage demand since the beginning of 2022.

In 2023,

- The average interest rate for a 30-year, fixed mortgage was 6.79%.

- Americans originated $1.1 trillion in new mortgage debt in the first three quarters of 2023 where most were issued to sub-prime borrowers with a credit score of more than 720.

Going forward, mortgage rates are expected to go down due to expected fed rate cuts. The effects of past rate hikes and inflation are now cooling down. The recent rapid decline in rates along with job growth may promote home sales. Refinance activity, sluggish over the last year, has started to pick up again amid declining rates. However, home prices may climb amid a tight supply of new homes listings.

It is expected that the mortgage rates mayaround to6.5% in mid 2024 due to the cooling of inflation and labor market weakness leading the Fed to cut rates.

Exhibit 7. Mortgage rates trend signals a cool-off.

Data Source:20-Y Mortgage rates, FRED

Image Source: © 2024 Krish Capital Pty. Ltd

Chart Takeaway:The rates have started to cool in early 2022 due to the expectation of federal rate cuts next year which may boost home sales and listing prices.

What can be expected from 2024?

In contrast to other major economies, the US grew at a robust pace in the third quarter of 2023. Core Inflation has fallen sharply, and the pace of job growth has been phenomenal since January 2022. The supply chain healing is underway.

The bottom line is that although it is expected that a broad range of DM and EM economies may avoid recession in the coming year, the case of US growth outperformance looks stronger. The US growth may lie further above the consensus estimates,with inflation having come down by mid-year and with central banks easing, growth may stabilize in the second half of the year.

The risk is low as compared to other economies, which makes it stable for invest- ments.However, a balanced portfolio approachis advisable.

Disclaimer – The information available on this website is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.