UK : 63, St Mary Axe, London, United Kingdom, EC3A 8AA

AU : Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

Email Us Mon-Fri, 10:00 AM to 6:00 PMEurozone Outlook 2024 – A Year of Sluggish growth

Image Source: kan_chana, Shutterstock

As we progress towards 2024, the Euro area is expected to find itself balanced between stagnation and recession. The first-rate cut is expected to come around June, although the timeline can be accelerated. As we go along, several of the headwinds earlier expected might be alleviated.

Firstly, the impact of volatile energy prices is expected to diminish as real disposable income sees improvement, fueled by decreasing inflation and rising wages.

Secondly, the drag from interest rate hikes in the last 18 months is projected to ease gradually in the latter half of 2024.

Lastly, manufacturing activity is seen to bottom out as the input inventories have experienced the largest fall since November 2009.

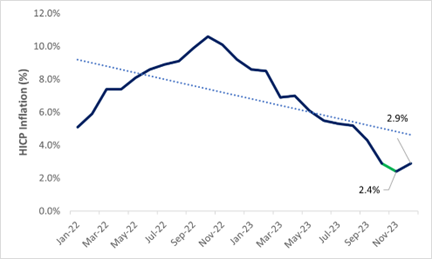

Exhibit 1: The descent of inflation

Image Source: © 2024 Krish Capital Pty.Ltd

Data source: Eurostat

Chart Key Takeaway-

Inflation in the Euro area increased to 2.90% in December from 2.40% in November 2023. The inflation rate in the Euro area averaged 2.22% from 1991 until 2023.

Looking at consumer inflation [Exhibit 1], continued low levels are anticipated in the coming months owing to subdued growth and base effects. ECB’s medium-term target by the end of 2024 is 2%.

Given the faster-than-anticipated inflation decline, the ECB faces mounting pressure to lower the interest rates. Simultaneously, the ECB is likely to reduce its balance sheet at a measured pace Pandemic Emergency Purchase Program (PEPP).

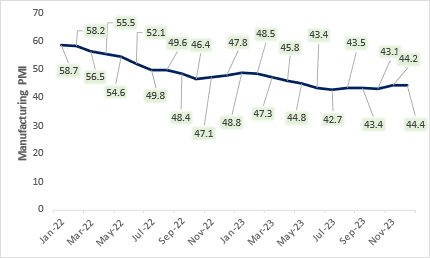

Exhibit 2: Manufacturing Activity Remains Subdued

Image Source: © 2024 Krish Capital Pty.Ltd

Data source: Eurostat

Chart Key Takeaway-

The PMI stayed above 44.4, though the overall trend remains contractive in nature as viewed by purchasing managers.

Eurozone Manufacturing PMI [Exhibit 2] surpassed the forecasted figure of 44.2. However, the sector remained in contraction due to new orders reduction. Business confidence has reached an eight-month high, despite this the euro area goods producers decreased their inventory levels. The producers offered discounts on selling prices as the input prices declined.

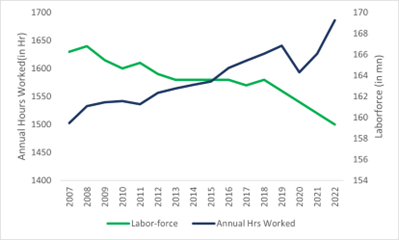

The labor market continues to be resilient amid the slowdown in construction and manufacturing. The Euro area unemployment stood at 6.4% in November, close to its historical low. [Exhibit 3]

Exhibit 3: Labor market resilience

Image Source: © 2024 Krish Capital Pty.Ltd

Data Source: Eurostat

Chart Key Takeaway-

The reduction in annual average hours worked has been offset by the increase in the labor force. However, the job vacancy rate has been declining suggesting labor market adjustment.

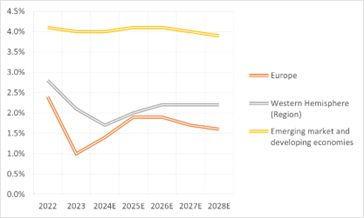

Major economies- The US, Eurozone, and China may face challenges and the growth may stay subdued. However, the Asia-Pacific region may remain the primary source of global growth with India, Vietnam, and Indonesia being the prominent growth economies.

The global economy may face high uncertainty with geopolitical conflicts, a reset of globalization, and technological advancements, particularly in AI. [Exhibit 4]

Exhibit 4: IMF Growth Forecasts

Image Source: © 2024 Krish Capital Pty.Ltd

Data source: IMF@2023

Chart Key Takeaway-

Emerging companies may contribute significantly to global growth in 2024 amid the slower growth in Western and Euro regions.

Tightened financing conditions with lending rates for businesses over 5% and mortgage rates increasing to 4%. This dampens the demand and pushes inflation down.

The bond markets are stable, sovereign yield spreads have been constant and investors have been able to absorb the extra securities released through balance sheet reduction. Euro banks have a comfortable level of capital and strong profitability which makes them stand strong against adverse shocks. But, despite that the valuations remain compressed raising concerns over the bank’s sustainable earnings growth and asset quality. [Exhibit 5]

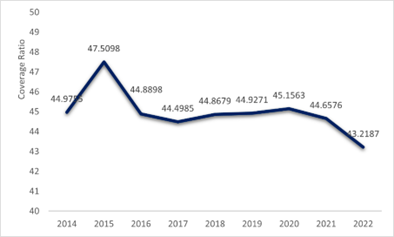

Exhibit 5: Euro composite banks's coverage ratio

Image Source: © 2024 Krish Capital Pty.Ltd

Data source: ECB portal

Key Chart Takeaway

Euro Banks asset quality has witnessed a slight downward sloping curve which is indicated by the coverage ratio of the bank’s composite.

A puzzling market response on equities

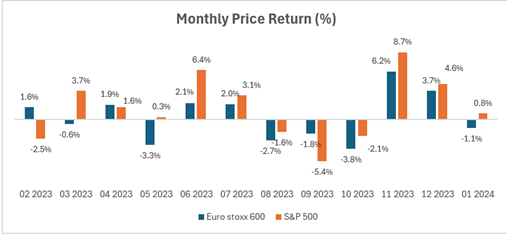

We believe markets have probably got ahead of themselves, particularly in the optimism of interest rate cut expectations. The greatest optimism on the near-term rate cuts is seemingly in the US, but let's not forget the US is supported by macro data which is the weakest in the case of Europe. [Exhibit 6]

Exhibit 6: S&P 500 outperformed Euro Stoxx 600 in 9 out of 12 times over the past year

Image Source: © 2024 Krish Capital Pty.Ltd

Data source: REFINITIV

Key Chart Takeaway

The markets, especially the Euro market remained flat and range-bound in 2023 mainly due to macro-economic headwinds.

The global outlook for equities is expected that both inflation and economic demand is to soften as the tailwinds for growth markets are fading. Building monetary headwinds, geopolitical risks, and expensive asset valuations may impact the performance of risky assets.

2023 had low growth expectations at the start but China’s re-opening, large fiscal stimulus in the US and Europe, strong company earnings, and the excess savings from covid era stabilized the growth.

Overall, the outlook for risk and growth assets looks bearish over the next 12 months. The primary reason is the interest rate hikes in the past 18 months may negatively impact economic activity. Geopolitical development remains an additional challenge as commodity prices and global trade of goods and services may get impacted. The current risky assets valuations look stretched upwards from the sustained average in the last years. Risky assets cannot have a sustainable rally at this level of monetary restriction or without a significant decrease in interest rates and quantitative easing.

The outlook for UK equities is optimistic given lower valuations and favorable sector compositions. Japan remains attractive with its stronger balance sheet, potential pickup in retail participation, and supportive policy.

EM should become more attractive through 2024 due to diversification benefits away from the US and lower investor positioning. EM outlook may be dominated by US growth and monetary policy cycles.

Conclusion

In the last 2 years, to curb inflation the ECB did its gradual reduction in the asset portfolio and increased the policy rates by 450 basis points. In terms of economic activity, the slowdown so far has been contained and gradual.

However, the future remains full of uncertainty with growth prospects slightly tilted downside. It is therefore crucial for the new fiscal framework to strike a balance between public finance and debt reduction on the one hand and room for new investments on the other.

Disclaimer – The information available on this website is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.