UK : 63, St Mary Axe, London, United Kingdom, EC3A 8AA

AU : Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

Email Us Mon-Fri, 10:00 AM to 6:00 PMDecoding Consumer Discretionary Spending in US: Trends & Transformation

Image Source: © 2024 Krish Capital Pty.Ltd

Nuts & Bolts of US Consumer Discretionary Sector

Highlights

-

Consumer spending behaviour appears to exhibit more strength in 2024 compared to 2022 and 2023.

-

In 2023, consumers demonstrated stronger spending pullbacks in major goods categories like clothing, electronics vs. services like leisure travel and restaurants.

-

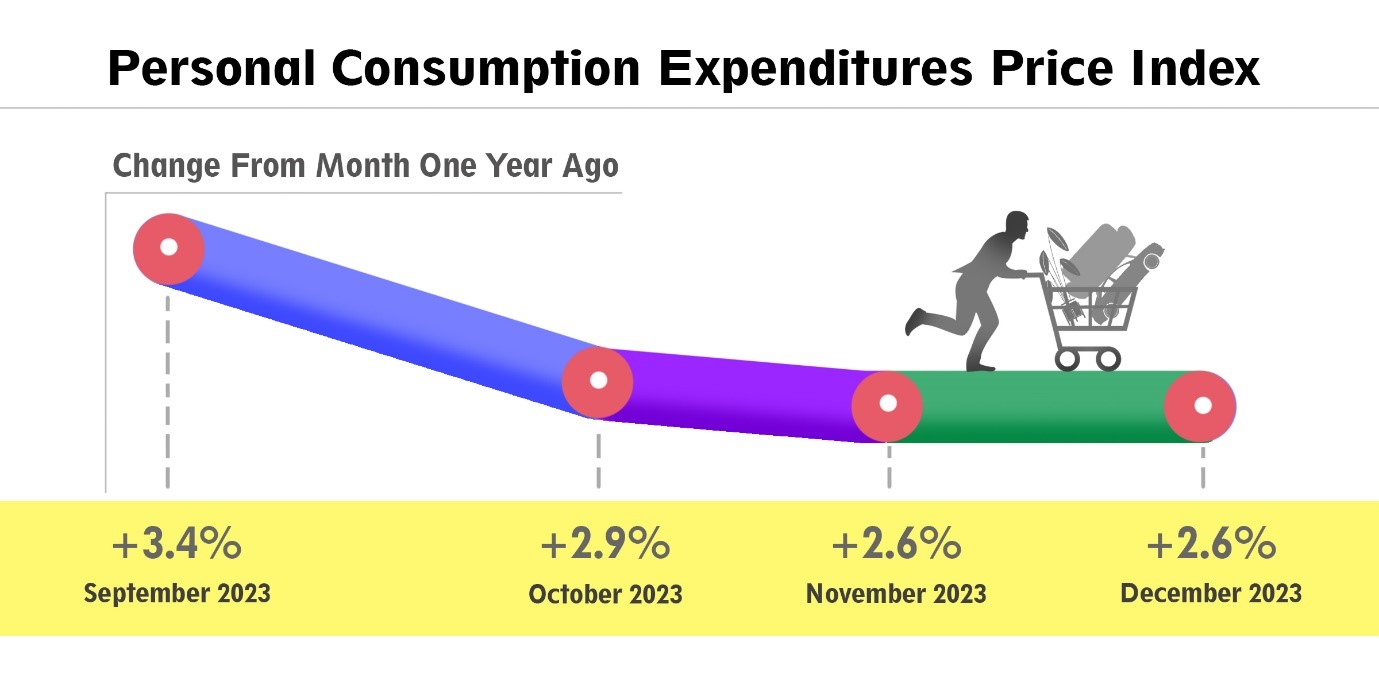

In 2023, the twelve-month inflation stood at 2.6 percent, marking a decrease from its peak at 7.1 percent in June 2022.

The evolving landscape of the past few years has significantly shaped the perspectives, actions, and purchasing inclinations of consumers in the United States. These effects have progressed through the challenges of the pandemic and persist in a demanding economic milieu marked by soaring inflation, recessionary threats, and geopolitical tensions.

This article aims to offer our readers insights into the shifting trends in consumer discretionary behaviour prevalent in the US, providing a nuanced understanding of the current state of the industry and its future trajectory in 2024.

A look at Americans’ indulgence in splurge purchases

The consumer discretionary sector encompasses non-essential goods and services that people can forgo or downgrade when facing economic struggles. It includes specialty food, high-end restaurants, travel and vacations, new cars, designer clothes, and even fancy coffee. These purchases see increased demand during good economic times, but take a hit when wallets tighten.

Here's a glimpse into the sector with some well-known companies of the United States:

-

McDonald's (MCD): While fast food might seem essential, it falls under discretionary spending due to its affordability and non-essential nature compared to groceries.

-

Starbucks (SBUX): Premium coffee and treats are discretionary indulgences many forego during tight budgets.

-

La-Z-Boy (LZB): Replacing a worn sofa is possible, but buying a brand new one is a discretionary purchase.

-

Whirlpool (WHR): Upgrading appliances is discretionary compared to essential repairs.

-

Walt Disney (DIS): Theme park visits and expensive entertainment fall under discretionary spending.

-

Carnival Corp. (CCL): Cruises are considered luxury vacations, a discretionary expense.

-

Nike (NKE): While essential sportswear exists, high-end athletic apparel leans towards discretionary spending.

-

Tesla (TSLA): New cars, especially premium ones, are discretionary purchases.

In the recent times, it has been observed that the Americans’ spending on discretionary goods and services is triggered by their impulse for comfort, relaxation, and consideration for long-term usage.

Image Source: © 2024 Krish Capital Pty.Ltd

How’s US positioned financially in terms of consumer spending?

The United States registers the weakest index performance among major economies. The injection of trillions in pandemic stimulus likely provided relief from financial strains caused by lockdowns in 2020 and early 2021.

However, the US index remained notably below the global average, experiencing a further decline as stimulus programs phased out and prices simultaneously surged. In June 2022, the index reached a low of 70.7, aligning with a peak inflation rate of 9.1% during that month.

While consumer sentiment rebounded swiftly as inflation alleviated, the upward trend was short-lived. The index remained stagnant throughout 2023 and has recently started to decline again in the past few months. Overall, the three-year index underscores some financial vulnerability among Americans. It suggests some financial fragility among the consumers in the United States.

Dominant factors influencing current spending decisions, especially discretionary spends

There has been a substantial YoY decline in private equity investment in the consumer discretionary sector in H1 2023. This downturn can be attributed to the impact of inflation and an uncertain macroeconomic outlook. However, H1 2023 saw several billion-dollar acquisition announcements, LIKE Blackstone Inc.'s $2.36 billion take-private bid for Rover Group Inc.

As of December 11, 2023, most corporate guidance updates for Q4 originated from four sectors: IT, consumer discretionary, industrials, and healthcare. While the majority of these updates raised quarterly or annual performance expectations, consumer discretionary stood out with guidance split 50-50 between heightened and lowered expectations. This divergence may reflect a sense of caution among consumers in the current macroeconomic climate.

Consumer spending habits affecting the forecasts of major US companies.

Noodles & Co., a popular fast-casual restaurant chain, faced rough waters in November, revising its FY23 revenue estimate downward. This downturn was partly attributed to a year-over-year decline in sales at its established restaurants. Similarly, European Wax Center Inc., a chain of waxing salons, also felt the pinch, scaling back its full-year sales and revenue projections due to economic concerns voiced by customers in surveys.

Interestingly, despite the challenging economic climate, omnichannel retailer Kohl's Corp. defied the trend by upwardly revising its guidance for 2023. However, they acknowledged the persistent macroeconomic pressures impacting their customer base.

While some, like Noodles & Co. and European Wax Center, are feeling the strain, others, like Kohl's, are finding ways to navigate the challenges.

Understanding consumer spending intent

Apparently, consumers in the United States are spending slightly more freely in 2024 than they did in 2022 and 2023, but this doesn't guarantee a complete rebound in confidence. In the year 2023, there were sharper reductions in spending on larger goods like clothing and electronics, compared to services like travel and dining.

Status of retail sales in US

As per a report released by the Commerce Department's Census Bureau, advance estimates of U.S. retail and food services sales dropped by 0.8% to $700.3 billion in January 2024, versus December 2023, and increased 0.6% as compared to January 2023.

In terms of retail trade sales, there has been a 1.1% decline from December 2023, and approximately 0.2% down on pcp. However, non-store retailers witnessed a 6.4% surge from last year, while food services and drinking places increased 6.3% from January 2023.

What’s the pace of inflation in US?

The latest data from the Bureau of Economic Analysis shows personal income on the rise and inflation cooling down. In December 2023, people brought home an extra $60 billion (a 0.3% increase) compared to the previous month.

Disposable income (money left after taxes) also saw a slight increase of 0.3%. Even better, spending jumped by 0.7%, reflecting growing consumer confidence.

Image Source: © 2024 Krish Capital Pty.Ltd, Data source: U.S. Bureau of Economic Analysis

Inflation, as measured by the PCE index, slowed down to 2.6% for the year, a significant drop from its 7.1% peak in June 2022. The trend is even more promising when looking at the last six months, with inflation at just 2%. Core inflation, excluding food and energy, also shows a positive trend, down to 2.9% from its February 2022 peak of 5.6%. It's even lower over the last six months, hitting just 1.9%. This decline in inflation is the most significant since the early 1980s, marking a positive step towards economic stability.

However, it's important to remember that progress hasn't been smooth - there have been ups and downs.

In summary, executive teams facing constraints such as cost inflation, tight labor markets, and changing interest rates should pivot their strategic agendas towards acquiring next-generation capabilities, diversifying revenue streams, optimizing operations, investing in talent, fostering strategic partnerships, and embracing sustainability. By proactively addressing these challenges and opportunities, organizations can navigate uncertainties and position themselves for sustainable growth and success in 2024 and beyond.

Disclaimer – The information available on this website is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.